News

Indonesian banks' profitability metrics declining steadily since 2013

Indonesian banks' profitability metrics declining steadily since 2013

Return-on-assets will remain flat at 2%.

Indian banks to require US$90b in new capital by March 2019

Half of it will have to be met through core equity.

3 factors that will cause Hong Kong banks' profits to decline

Subdued loan growth is one.

Taiwanese banks' mainland China exposure down to 6.2% in 2Q16

It reduces the risks from deleveraging spilling over into Taiwan.

Australian banks' asset quality metrics to come under further pressure

But funding profiles continue to improve.

Bangkok Bank CEO hopes Thailand's NPL ratio won't peak at 4%

But analysts think this scenario is "too pessimistic".

Are Singapore banks' NPL woes finally over?

Government support to O&G firms brought some respite.

Hong Kong banks' mainland China exposure to exceed 30% of system-wide assets by end-2017

Thanks to Chinese corporates' aggressive international expansion.

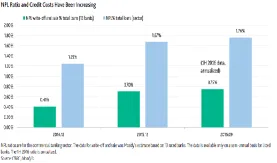

Chart of the Week: Chinese banks' NPL ratio and credit costs edge up as at end-September 2016

NPL ratio reached 1.76%.

Weekly Global News Wrap Up: EU's planned banking reform criticised; RBS to pay investors $1b

And Russian banks lose $31m in cyber attacks.

Thai banks to see gradually declining delinquencies in 2017

But asset quality pressures will persist.

Vietnam banks' problem assets ratio reaches 7.1% in the first half of 2016

That's including the gross value of assets sold to the Vietnam Asset Management Company.

3 factors that will pressure Chinese banks' profits in 2017

Rising credit costs is one.

Malaysian banks' loan growth 'significantly slower'

Growth slowed to 2.3% as at end-September 2016.

Weekly Global News Wrap Up: Standard Chartered to cut 10% of corporate banking staff; Two new online banking safeguards to be launched

And Aussie banks can't bypass Apple's in-house payments.

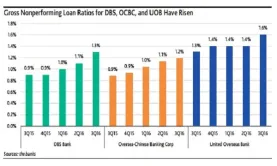

Chart of the Week: Check out the Singapore banks' escalating NPLs since late 2015

Majority of new NPLs are to oil service companies.

Why India's demonetisation benefits won't support banks' credit profiles

Uncertainties offset the positive effects.

Advertise

Advertise