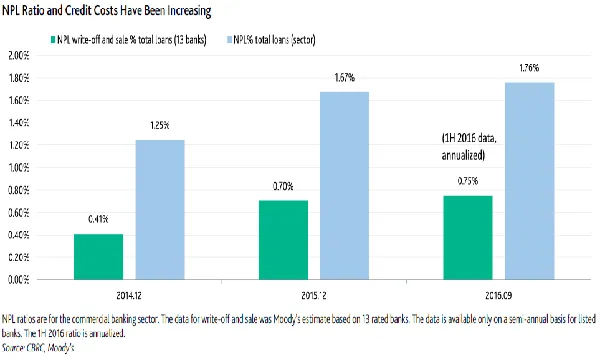

Chart of the Week: Chinese banks' NPL ratio and credit costs edge up as at end-September 2016

NPL ratio reached 1.76%.

Moody's believes despite the challenging operating conditions, any deterioration in headline asset quality metrics will be gradual, and be mitigated by:

» Improving financial metrics among some companies previously under overcapacity pressure, in particular mining and steel producers which have seen output prices stabilize in 2016.

» Increasing measures to support distressed companies. Because debt restructuring in China tends to take place before borrowers fall into payment arrears, banks can report the renegotiated loans as normal loans.

"As of the end of September 2016, the banking sector reported an NPL ratio of 1.76%, compared with 1.67% at end-2015 and 1.25% at end-2014. Credit costs also edged up over the same period."

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise