News

Indonesia tax amnesty programme to have limited impact on Singapore banks

Total overseas asset declaration stood at S$108b.

Malaysian banks' deposits growth slowed to 2% in December

Business deposits contracted 2.3%.

Chinese bankers brace for "brutal bonus season": Reuters

Dwindling business on local stock markets is to blame.

Japanese banks' loan growth expected to slow in 2017

Blame it on the rising costs of foreign-currency funding.

Indian banks' loan growth predicted to be below 10% in FY17

It may even slow from the 8.8% recorded in FY16, says Fitch.

Malaysian banks' loan growth up 5.3% in 2016

Household and non-household loans also expanded at a similar rate of 5.3%.

Asian Banking and Finance Wholesale Banking Awards 2017 now open for nominations

Entries are accepted until April 14.

Weekly Global News Wrap Up: EU banks could take up to 5 years to Brexit; Deutsche Bank fined $630m; Citi launches lending website

And find out what the biggest bankers are planning post-Brexit.

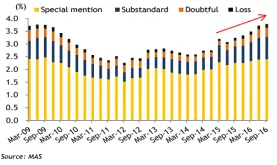

Chart of the Week: Singapore banks' classified exposure level at its worst since 2009

The banks' credit quality is still worsening.

Indian banks' asset quality indicators close to their weakest levels

Recovery will be slow over the next few years.

Hong Kong banks still well capitalised despite poor profit outlook

Total capital ratio came in at 19.4% in September 2016.

3 implications on banks' financials when MFRS 9 takes effect in 2018

One is that there will be a one-off provision charge to retained earnings.

Australian banks' dividend payout 'increasingly unsustainable'

Analysts recommend cutting dividends to preserve cash.

Are Thai banks resilient enough to withstand negative sector trends?

Capital and loan-loss buffers are adequate, says Fitch.

Japanese banking sector assets as a share of GDP now at a record 211%

Total assets were up 5.5% in November 2016.

Philippine banks' loan-to-deposit ratio among the lowest in Asia

This reduces refinancing risk in the banking system.

Advertise

Advertise