News

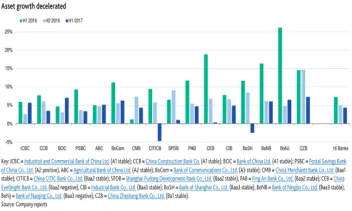

Chart of the Week: China banks' asset growth slows in 1H17

Chart of the Week: China banks' asset growth slows in 1H17

Growth decelerated to 4.4% in the first half of the year.

India mulls including bank recapitalisation bonds in mandatory reserves

The goal is to save the country's cash-strapped banks.

Vietnamese banks' problem loan ratio to improve to 6% in 2018

It already declined to 6.5% in June this year.

China's big banks post higher profits and slower bad loans growth in Q3

Thanks to a 'cocktail of policy measures'.

Singapore's bank loans growth hits 5.9% for the first nine months of 2017

It's a big jump from the -0.6% in 2016.

Weekly Global News Wrap Up: European banks forced to share data with fintechs; EU scraps proposal for banks to split up

And find out how personal banking is evolving.

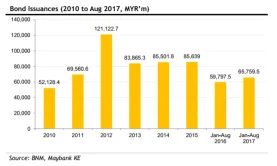

Chart of the Week: Malaysian banks' bond issuances up 10%

Issuances hit US$2b in August 2017.

India's state banks to receive $32b of capital over two years

India eyes recovering from a 25-year low bank loan growth.

These initiatives could help Malaysia remain a regional Islamic banking hub

New human capital development programmes will complement existing ones.

Singapore banks' margins boosted by Fed, Hong Kong rates

UOB will benefit the most from stronger margins.

Thai banks' 3Q17 earnings 'disappointedly weak'

Profits missed consensus by 8%.

Australian banks' stable profitability to offset risks for the next 12-18 months

What factors are behind the stable outlook for Australian banks?

Weekly Global News Wrap Up: US banks look beyond trading; JPMorgan launches new payment processing network using blockchain

And find out why Canada's alternative lenders face bigger impact from new mortgage rules.

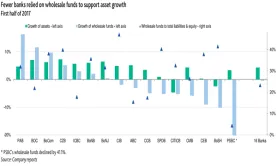

Chart of the Week: Fewer Chinese banks relied on wholesale funding for asset growth

The maturity profiles of wholesale funds also improved.

What could drag the Japanese banks' strengthening capitalisation?

It's a continued shift toward assets with higher risk weights.

Philippine banks' asset performance metrics to be stable for the next 18 months

Thanks to robust economic growth and low interest rates.

Thai banks' NPL risk to gradually improve by end-2017

Overall credit costs will still be high but will eventually ease.

Advertise

Advertise