News

UOB unveils digital advisory service for corporate investors

UOB unveils digital advisory service for corporate investors

The new service is exclusively for UOB’s commercial banking clients.

Singapore banks target lower credit cost in 2018

Every 5bp decrease in credit cost can lift sector earnings by 3%.

3 trends in Indonesia's shift to digital banking

Big banks are now adapting to the current digital trends.

70% of Chinese banks expect bad loans to dip 2%

Most bankers are confident in results in the next three years.

Weekly Global News Wrap Up: JPMorgan, Goldman are top payers; Banks want digital specialists

And Wells Fargo’s consumer complaints dropped in 2017.

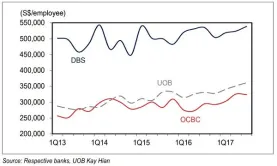

Chart of the Week: See which Singapore bank has the most productive workforce

Productivity in all three banks has improved in 3Q17.

Singapore banks' wealth management income grows 39%

All three banks registered absolute growth in 9M17.

Indonesian banks' loan growth remains weak at 3.8%

This may also be the case in 2018 despite better economic growth.

What is the progress of financial integration in ASEAN banks?

Some countries have already started negotiating to meet the deadline.

Philippine banks' consumer loans jumped 16%

Local banks keep zeroing in on consumer lending to spur growth.

Hong Kong banks' loan growth predicted to hit 18% for 2018

The forecast rose from 7.5% as lending to private companies grew.

Thai banks' earnings slip 8% YoY in 4Q17

They will continue to struggle in early 2018 as it dips by 1% QoQ.

Malaysian banks' credit growth hits 5.5% in Nov 2017

It compensated for the sluggish 3.9% industry loan growth.

Weekly Global News Wrap Up: Amazon may buy a bank in 2018; Four US banks' 'living wills' have shortcomings

And Britain's Competition and Markets Authority extends deadline for open banking implementation.

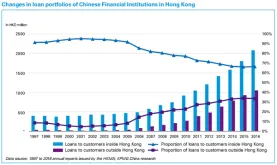

Chart of the Week: See how the loan portfolios of Chinese banks in Hong Kong changed since 1997

Their portfolios are becoming more global.

Thai banks' net interest income to grow 3.8% in 2018

Growth will be moderate despite the increase in loans.

Check out which Singapore bank is the most cost-efficient

It has the lowest staff cost per employee at US$61,800 (S$83,333). UOB Kay Hian reports OCBC leads in cost efficiency with the lowest staff cost per employee and ‘very lean’ non-wage expenses. This is against US$89,600 (S$120,830) for DBS and US$64,900 (S$87,620) for UOB. However, DBS’ staff cost per employee grew at a slightly slower CAGR at 3.6% for 2013-17, vs 4.8% for OCBC and 4.9% for UOB. Staff cost accounted for 61.6% of operating expenses for OCBC despite its lower staff costs per employee, vs 56% for DBS and 55.3% for UOB in September 2017. DBS also leads in productivity with the highest income per employee at US$399,500 (S$538,805) as of 3Q17 (annualised), significantly above the US$239,800 (S$323,465) for OCBC and US$267,900 (S$361,289). This is mainly due to its established presence in Singapore and Hong Kong with market shares, which are major financial centres, estimated at 20.6% and 4.2% respectively. According to UOB Kay Hian, OCBC and UOB's income per employee grew at a faster CAGR at 4.7% and 5.6% respectively for 2013-17, vs 2.1% for DBS. OCBC’s income per employee stayed flat in 2015 and 2016, possibly held back by the integration of Wing Hang Bank, but had improved 11% ytd in 9M17. UOB’s income per employee has grown steadily at CAGR of 5.6% for 2013-17. DBS has the highest PPoP per employee at US$232,600 (S$313,701), vs US$135,400 (S$182,703) for OCBC and US$151,500 (S$204,284) for UOB. OCBC and UOB registered faster growth with PPoP per employee expanding at CAGR of 4.4% and 4.9% respectively for 2013-17, vs 2.1% for DBS. DBS has the smallest workforce at 23,114, whilst OCBC had the largest headcount of 29,161 as of September 2017. UOB has kept headcount relatively unchanged as it maintains an ASEAN-centric footprint and did not partake in any major M&As.

Advertise

Advertise