News

Hong Kong banks' prime rates will not immediately rise after Fed hike

Banks have enough money to delay its implementation.

How can IFRS 9 change banks' lending strategies?

The modification would be for a long-term positive accounting outcome.

Double-digit growth in fee income cheered Singapore banks in Q4

Thanks to wealth management and capital market services.

Chun Man Hui of Software AG to speak at the 2018 Retail Banking Forum in Manila

His presentation will cover the significance of open banking.

Big Australian banks brace themselves for foreign competition in transaction banking

Corporate clients seek out new partners with trade finance capabilities.

South Korean banks to expand in ASEAN countries

Thanks to the low interest rate environment and rising competition from online banks.

How can Indian banks take more advantage of open banking?

It involves consumer centricity and building alliances at the core of their strategy.

PSBank's Jose Martin Velasquez to discuss the efficiency of digital transformation at the 2018 Retail Banking Forum in Manila

He will also talk about how banks can grow from shifting their strategy to retail banking.

Singapore banks' profits soar by 27% in Q4

DBS, OCBC, and UOB made a whopping $11.9b in 2017.

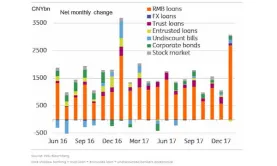

Chart of the Week: Check out how China's shadow banking items shrank in 2018

There was a 17% YoY reduction of total social financing.

Weekly Global News Wrap Up: Australian banks risk misconduct exposure; Deutsche Bank to cut more jobs

And UBS hikes Asia investment banking bonus pool.

Deleveraging helps moderate China banks' growth

Loan growth may moderate by 1-2 ppt in 2018.

Big Hong Kong banks lock mortgage rates amidst Fed hike worries

HSBC and BOC locked their rates at 1.68% which is lower than the industry standard of 2.15%.

APAC fintech market to reach US$72b by 2020

Increasing use of digital payments will fuel the growth.

India discovers $3.6b of banks' hidden bad loans: Bloomberg

This amplifies concerns about underreporting and distress in the financial sector.

China banks to benefit from debt to equity swaps

They expect improvement in overall asset quality with bad loans resolution.

Advertise

Advertise