News

Four things that could weigh on Aussie banks' earnings in 2019

Four things that could weigh on Aussie banks' earnings in 2019

But banks are still in a "sweet spot" for now.

What could ease the pressure on Indian banks' profitability?

Funding and credit costs are expected to be lower.

Why Singapore banks will still be laden with O&G woes

Every 10bps increase in credit cost estimate will cause a 7% cut in net profits.

Weekly Global News Wrap Up: Big US banks could see 20% profit jump; British banks to close 762 branches this year

And find out why Goldman Sachs will explain its trading strategy.

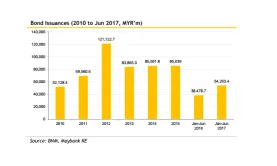

Chart of the Week: Malaysian banks' bond issuances hit US$12.7b in 1H17

It's a 41% increase from the same period last year.

Hong Kong banks' funding and liquidity conditions to remain benign till 2018

But potential funding volatility will come from changes in banks' loan and deposit currency mix.

Shadow banking risks focused on China's regional lenders

Rust belt banks use shadow banking to conceal their bad loan status.

Consolidating public sector banks in India still won't improve weak capitalisation

But the mergers could provide scale efficiencies and improve the quality of corporate governance.

Singapore banks' non-interest income to increase by up to 15%

Thanks to wealth management fees and net trading income.

Why Thai banks are well placed to absorb loan losses

They have enough reserves even if 25% of thier restructured loans become NPLs.

Vietnamese banks' asset quality expected to improve with new collateral repossession rules

Banks can now speedily repossess collateral for a nonperforming loan.

How will Indonesian banks' NPLs be impacted by the end of OJK's lenient restructuring?

NPLs will remain close to 3% by the end of 2017.

China's largest banks raise billions to fund Belt and Road investments

China Construction Bank eyes raising at least $15b.

Weekly Global News Wrap Up: US banks' profits up 10.7% to $48.3b; How big tech is disrupting banks

And find out why Frankfurt and Dublin seem to be winning the battle for Brexit jobs.

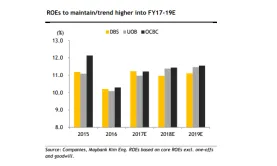

Chart of the Week: Singapore banks' ROEs to trend higher into FY18-19E

Maybank Kim Eng outlines three reasons behind this forecast.

Indian banks remain 'moderately capitalised'

Overall Capital Adequacy Ratio stood at 13.74% as of March 2017.

Why the property sector remains a key risk for Hong Kong banks

The prevalence of high-LTV second mortgages increases default risks for homebuyers.

Advertise

Advertise