Who's winning China's retail banking race?

The top bank raked in RMB238 billion in 2014.

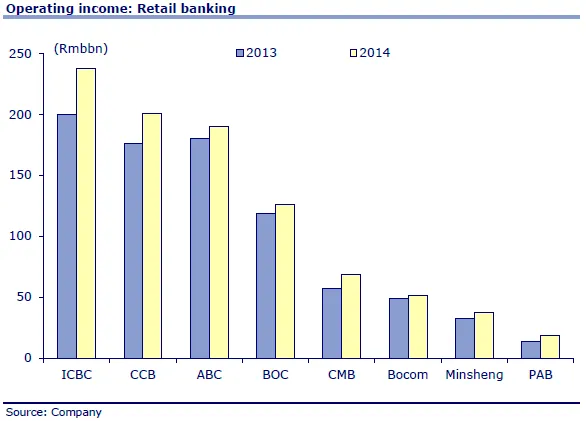

By operating income from retail banking, CLSA notes that the competitive landscape looks a bit different. ICBC still has the lead, taking in Rmb238bn last year. The second is CCB and third ABC.

Here's more from CLSA:

This suggests that CCB’s clients, despite being outnumbered by ABC, generate more value to the bank. The other outlier is BOC. It is still at the number-four position but the gap to others is much wider.

It’s just a bit over half the size of ICBC’s. By total assets, the difference is only about 25%.

This underscores BOC’s traditional strength in corporate, and its weakness in retail, which makes up only 28% of total operating income. The best retail franchise goes to CMB.

In absolute size, its operating income from retail banking is not yet 30% of ICBC’s. But of its own operating income, the retail segment has a 41% contribution, the highest of all. ICBC follows with 37%. Both ABC and CCB are at 36%. Just a note, operating income is mainly made up of retail, corporate and treasury.

The growth accolade goes to PAB, which is primarily a corporate bank - where corporate deposits are five times the size of retail.

This is a legacy problem because of its predecessor’s association with Shenzhen government and local enterprises there. The bank therefore has been the most aggressive in its retail expansion and transformation.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise