Vietnam’s card payments market to hit $37.6b in 2022

The government’s cashless payments push is helping the market.

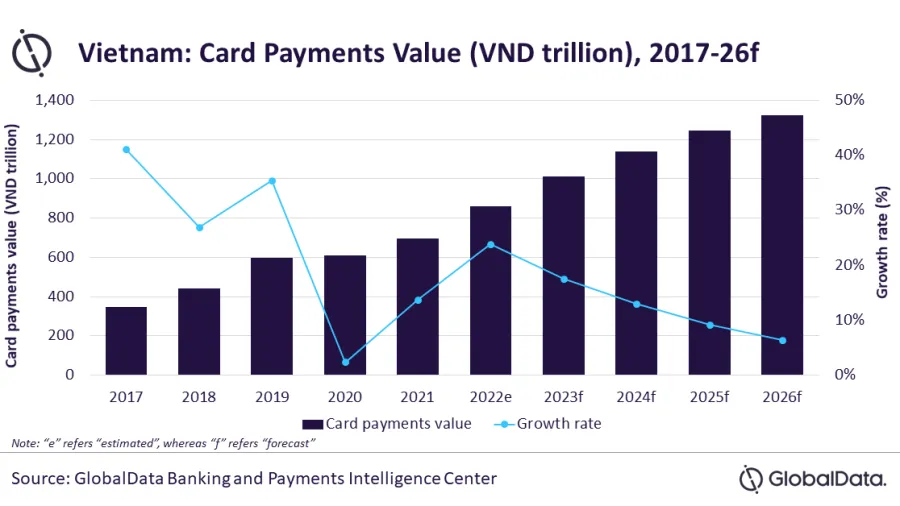

Vietnams’ card payments market is expected to grow by 23.8% to $37.6b (VND859.2t) in 2022, according to a report by GlobalData.

Rising consumer spending, coupled with the government’s push for digital payments, will push up the market, the data and analytics firm said.

“Whilst cash remains the preferred mode of payments in Vietnam, there has been a rise in card payments in the country supported by government financial inclusion initiatives to increase financial awareness, promote electronic payments, and enhance access to banking services in the country,” said Ravi Sharma, lead banking and payments analyst at GlobalData.

“The introduction of mobile van branches in remote locations, the rising number of digital-only banks, and the adoption of payment technologies such as EMV and contactless are all supporting an increase in banked population and electronic payments in Vietnam,” he added.

The rise will extend the 13.7% growth the market registered in 2021. Card payments received a boost in 2021 due to the gradual recovering of the local economy and opening up of businesses.

ALSO READ: BNPL, digital wallets accelerates growth of e-commerce fraud: study

Late in 2021, the government approved the cashless payment development project, with the goal of increasing the banked population to 80% by the end of 2025 and register a 20 to 25% growth rate in cashless payments between 2021 to 2025.

Vietnam is also seeing heavy investments in payments infrastructure to accommodate non-cash payments, GlobalData said.

The number of POS terminals in the country rose from 278,000 in 2019 to nearly 375,000 as of October 2022. In addition, there are reported now over 100,000 QR Code accepting points to support electronic payments.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise