Chinese banks suffer heavy losses as delinquencies hit $17.88b in January

The energy sector saw the most defaults of $6.94b.

China’s banking sector is shouldering the heavy burden of higher delinquencies which rose from 2017 to a record $17.88b (RMB119.6b) in January, according to DBS.

The energy sector saw the most defaults of $6.94b (RMB46.4b) followed by consumer companies. By location, Shanghai booked the most number of defaults at almost $4.49b (RMB30b) followed by Shangxi $2.47b (RMB16.5b) and Zhejiang $1.54b (RMB10.3b). The private sector also accounted for 90% of those with tight credit conditions.

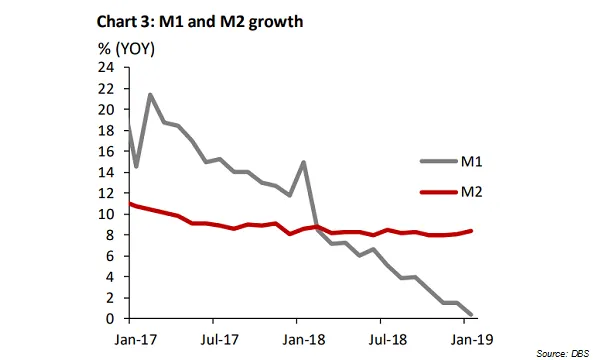

“The resulting deterioration of corporate cash flow was evident by collapsing M1 growth,” Nathan Chow, strategist/economist at DBS said in a report. “Given the reduced risk appetite and huge maturing volume, the outlook is poor, with $523.23b (RMB3.5t) in corporate bonds due in the next twelve months.”

Also read: Retail delinquencies add to Chinese banks' bad loan woes

Further aggravating the liquidity strain are climbing real interest rates which have risen to 4.3% in January from as low as -3.1% in Q1 2017. “The consequential tighter monetary conditions would add to the financial stress on Chinese firms with high leverage and maturity mismatches. That doesn’t bode well for their debt repayment ability,” said Chow.

China's real estate sector has been facing one of the most severe funding pressure especially against the ongoing property downturn. Home sales by floor area has slowed to a mere 2.2% growth in 2018 from 22.4% in the previous year. Moreover, the liquid assets of property firms are only able to cover 58% of their liabilities which is the lowest amongst all industries.

Also read: Chinese banks face risk from surging real estate bad loans

The government has repeatedly eased fiscal policy in an attempt to mitigate the impact of the economic slowdown through a series of tools and stimulus designed to encourage banks to unleash more funds. “Whilst further corporate defaults appear inevitable, credit spreads have stabilised, and the stock market has staged a nascent rebound (the CSI 300 is up by 13% ytd),” said Chow.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise