News

Singapore banks brace for higher risk weighted assets

Singapore banks brace for higher risk weighted assets

RWAs could increase by 25% by 2022 and 80% by 2027.

Crowdfunding flourishes in Malaysia as banks reject loan applications

Equity crowdfunding and P2P platforms have raised $84m for small businesses so far.

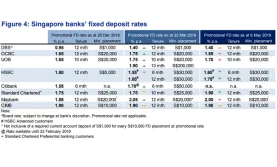

Singapore banks' fixed deposit rates to maintain sustained easing

FD rates have already started tapering off in April.

India makes headway with public bank mergers

India is reportedly aiming to merge Punjab National Bank with up to three other banks.

Singapore sets up banking conduct committee

It will serve as a platform for banks to self-asses and update industry codes of conduct.

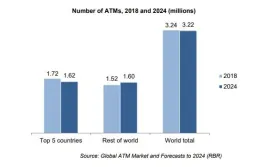

Chart of the Week: Global ATM numbers drop for first time as China, India and Japan shun cash

The growing popularity of mobile payments is partially to blame.

Japanese megabanks' annual profits fall as ultra-low rates take toll

Mizuho's profits plunged 83% to $877m.

Which Singapore bank pays its staff the most?

This lender enjoys higher income from its institutional banking and treasury markets units.

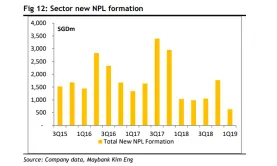

Singapore banks stand strong against bad loan wave in Q1

The formation of new bad loans in Q1 was the lowest in five years.

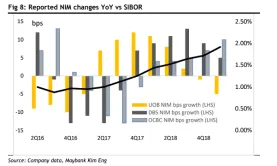

Singapore bank NIMs up 3bps in Q1

UOB was the only weak link as margins shrunk 5bps.

Japanese megabanks still reeling from lower net income

Sumitomo Mitsui projects a net income decrease of 4% to $6.39b in 2019. Bloomberg reported that Japanese megabanks are bracing for another tough year ahead of weakening net income amidst the weakening economy, rising trade tensions, and the sustained monetary easing from the central bank. Also read: Japanese bank woes to persist as ultra-low rates to last until 2020 Whilst both Mizuho and MUFG are expecting profit to increase this year, to $4.3b (JPY470b) and $8.22 (JPY900b),respectively, that’s only after they booked large writedowns that hurt results in the previous period. Meanwhile, Sumitomo Mitsui sees net income slipping about 4% to $6.39b (JPY700b). Net income projections from Sumitomo Mitsui Financial Group (SMFG), Mitsubishi UFJ Financial Group, and Mizuho Financial Group have all missed analysts estimates amidst rising bad loan costs and lesser gains from sales of stock holdings, which used to be its saving grace amidst rock-bottom interest rates. Also read: Japanese banks hit by lower net interest income as loan demand dwindles

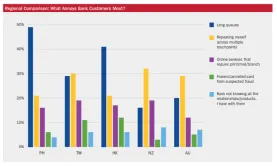

Chart of the Week: What annoys APAC bank users the most?

Frozen credit cards no longer spark as much annoyance.

Weekly Global News Wrap Up: HSBC, Citi, JPMorgan amongst those facing EU fines over forex rigging: report; UniCredit gears up for Commerzbank's bid

And Austrian Post is venturing into branch banking.

Philippine banks' profits surge 28% in Q1

Strong gains from trading and lending pushed up earnings.

Chinese banks stem lending in April as debt worries rise

Banks extended $150.16b in net new yuan loans.

Taiwan intensifies financial consultant oversight amidst theft reports

Fines for thefts committed by financial consultants since 2012 hit $2.78m.

Thailand banks' loan growth to slow to 4.5% by end-2019 as mortgages take hit

The LTV limit of 80% on home loans will cool demand for mortgages.

Advertise

Advertise