News

Singapore banks' bad loan ratio to hit 1.7% by 2020

Singapore banks' bad loan ratio to hit 1.7% by 2020

Blame higher delinquencies from SMEs and non-financial firms.

Taiwan embraces facial recognition in online banking

Taishin Bank will utilise the technology for clients with iPhone X by Q3.

Korea banks on big data infrastructure

It will create a financial data exchange for financial players in the country.

Japanese lenders team up with global banks for blockchain-based digital coin

It will be used to speed up overseas money transfers.

Open banking could uplift Australian banks

The big four banks will be required to make data available for transactions by February 2020.

Here's why Indian shadow banks are looking overseas

They have already clinched more than $2b worth of overseas bonds and loans in 2019. Bloomberg reports that shadow banks in India are looking outside the country in search for earnings amidst lenders that have been hesitating in extending funds.

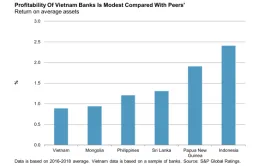

Chart of the Week: Check out Vietnamese banks' return on average assets

It lags behind the Philippines and Indonesia.

Weekly Global News Wrap Up: JPMorgan faces deposit growth slowdown; Estonia to expedite crackdown on Europe's $230b dirty money scandal

And PayPal injects $11m in Swedish financial startup Tink.

Singapore banks' loan growth slows further to 1.37% in April

Housing loans fell to a three-month low at $202.76b.

Thailand eyes integrating biometrics into account openings by Q3

Exits for the trial period of the service could start in Q3 2018.

Tougher mortgage rules await smaller Korean banks

The scheme is an attempt to help stabilise home prices. Korean second-tier banks will be subject to more stringent mortgage rules called Debt Service Ratio (DSR) by June, reports Yonhap. The move is an attempt from authorities to dent the growth of household debt and stabilise home prices.

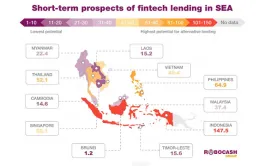

Here's where alternative lending thrives in Asia

The land of GoPay and OVO is no man’s land for banks.

Taiwanese banks eye shorter banking hours as more clients opt for online banking

A number of branches by Taiwan Business Bank will close an hour-and-a-half minutes earlier.

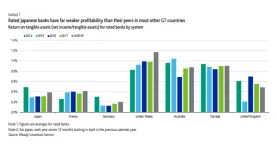

Chart of the Day: Japan banks' profitability still lag behind G7 peers

The sector’s return on assets hit 0.4% in H1 2018, below 1.2% in the US and over 0.8% in Australia. This chart from Moody’s Investors Service shows that although the average return on assets (ROA) of rated Japanese banks rose to around 0.4% in the first six months of 2018, the sector’s profitability remained far below that of banks in most other G7 countries such as the United States, Australia, Canada and the UK. Also read: Japanese banks hit by lower net interest income as loan demand dwindles

Weekly Global News Wrap Up: German banks need $5.9b additional capital buffer; Citigroup ditched Apple Card partnership talks: report

And UniCredit eyes to sell $5.6b worth of bad loans.

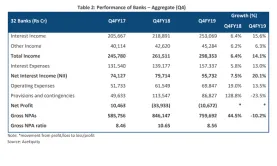

Indian banks maintain strong earnings momentum in Q4

Year-end interest income rose 15.6% amidst sustained credit recovery.

Korea rejects two web-only bank applicants

It cited lack of innovation and concerns over governance and financing.

Advertise

Advertise