News

Sri Lankan banks' bearish outlook to extend until end-2019

Sri Lankan banks' bearish outlook to extend until end-2019

The country is still reeling from the aftermath of the Easter Sunday attack last April.

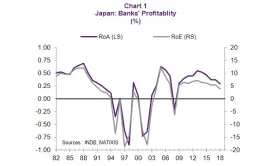

How did Japan's banks survive without passing on negative rates?

Despite tight margins, Japanese banks have higher survival chances than European banks.

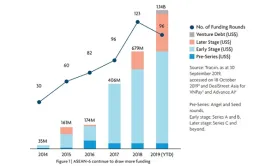

Singapore fintechs nab 51% of funding in ASEAN as of Q3

Singapore Life’s $150.39m funding was amongst the year’s notable deals.

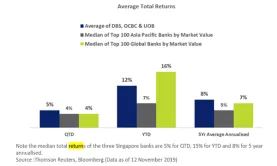

Singapore's big three banks averaged total return of 12% YTD

DBS, OCBC and UOB have averaged an 8% YTD growth in net profit to a combined $11.85b.

China's ailing small lenders stay afloat through local government bailouts

In at least one deal, non-performing loans were sold at above-market rates.

Central Bank of France to open first Asian office in Singapore

It aims to forge closer relations with APAC central banks and financial authorities.

China may launch digital currency in 2-3 months

They already have a system and network ready.

Weekly Global News Wrap: HSBC and RBS gears up digital banking platforms; Former bankers from Deutsche, Nomura fined $162m

And Deutsche Bank AG top officials worry that its new senior hire may not be up to the task.

Chart of the Week: Systemic risks still weighing on Asia's fintech markets

Even the world’s biggest fintech market, China, suffers from substantial industry risk.

Malaysia's central bank extends maximum tenor of repo to 5 years

This expands the previous deadline of only one year.

South Korea launches digital open banking service

Users may access all local bank accounts through their own mobile banking apps.

Singapore's central bank may extend $225m fintech funding programme beyond 2020

It eyes increased investments in cybersecurity and AI.

Rocky road ahead for profits of China's smaller banks

Their reliance on government bonds and lack of structural change are worrisome in the long-term, according to Natixis.

Singapore seeks to be Southeast Asia's virtual bank and fintech hub

It seeks to tap into a digital channels market which could be worth $110b by 2025.

Australian banks' earnings to remain under pressure in FY2020

No thanks to growing customer remediation costs.

Indonesia's wealth management prospects brighten over affluence growth

Mass affluent individuals are expected to grow to 1.6 million by 2022.

Philippine household lending grew 26.2% in September

This was due to growth of motors, credit card, and salary-based consumption loans.

Advertise

Advertise