News

India, China, Thailand lead APAC smart card market adoption

India, China, Thailand lead APAC smart card market adoption

The global smart card market will surpass $65b by 2025.

Australian banks asset quality still strong despite surging mortgage arrears

Capital ratios of major banks rose ahead of higher capital requirements by 1 January.

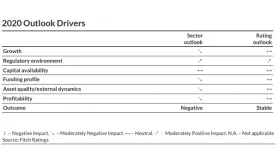

APAC banks to face rising bad loans, shrinking margins in 2020: Moody's

Rising credit provisions amidst falling interest rates will add pressure to banks’ profits.

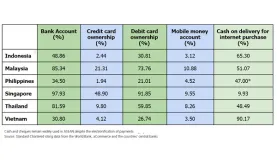

Who's winning in ASEAN's cashless race?

According to Standard Chartered, cash and cheques still reign supreme although evolving customer expectations are prompting incumbents to rethink of more efficient ways to handle transactions.

Singapore crowned as APAC's fintech leader

In APAC, only Singapore and Indian cities made it into the global top ten.

India may slash benchmark rates by 25bps in February

High unemployment and a subued manufacturing sector will drive rate cuts.

Weekly Global News Wrap: Morgan Stanley cuts 2% of its workforce; Saga floats virtual currency

And Swedbank overhauls top management after a money laundering scandal.

China to list 10 commercial banks as D-SIBS

The ‘big’ four banks are likely to fall one rank below being identified as most systemically important.

Malaysia's loan growth slows to 3.2% in October

Loan applications slimmed by 1.1% in the same month.

Hong Kong virtual banks to make up 2-3% of total deposits by 2020: report

They are expected to attract “tens and thousands of customers" each.

Tougher times ahead for APAC banks as their risk appetite grows

Conditions make it hard for banks to boost earnings without taking more risk.

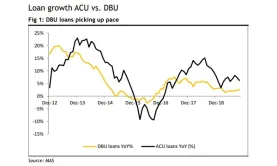

Chart of the Week: Singapore domestic loans up 2.6% in October

This is its fastest expansion since February 2019.

Weekly Global News Wrap: Deutsche Bank sells $50b in assets to Goldman Sachs; Lebanon to slash interest rates

And 37 emerging markets cut their benchmark interest rates in November.

Chinese regulation on ‘too big to fail' banks could reduce financial risk: analysts

It will improve transparency in the sector.

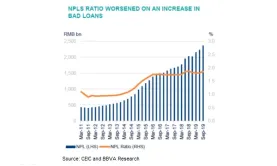

China's banks asset quality deteriorates as NPLs mount

NPL ratio climbed 3 bps compared to end-2018.

Indonesia's non-bank financial firms could face closures in 2020: analyst

The minimum capital requirement may force them to consolidate or even cease operations altogether.

Singapore, Japan central banks extend bilateral currency swap program

Under the agreement, Singapore provides yen liquidity to eligible financial firms to support cross-border operations.

Advertise

Advertise