Thailand

Thai central bank to monitor US Fed rate cut

Thai central bank to monitor US Fed rate cut

It is expected to further slash its benchmark interest rate of 1%.

Siam Commercial Bank face dampened 2020 growth prospects: analyst

NPL ratio will likely rise to 3.7% this year.

ASEAN lenders on the defense amidst oil volatility, COVID-19

Falling visibility is evident despite lower prices and stimulus measures.

Krung Thai Bank faces headwinds over sluggish loan demand

Net loan growth rose 0.9% in January versus a 1.6% increase in December.

COVID-19 pushes Thai asset manager to the top

Bangkok Commercial Asset Management’s shares ballooned by 74% this year.

Thai banks' loan growths, asset quality may dwindle due to coronavirus

Profit levels, strong capital, and good coverage ratios may soften short-term impacts.

Thai banks on an overseas buying spree

But this could reduce their capital buffers and create additional risks.

Thai banks' net profits expected to grow 27% in Q4 2019

But earnings are down 6% over the same period due to higher operating expenses.

Thailand's central bank maintains policy rate at 1.25%

It will likely remain on hold in 2020, although a 25bp cut remains probable.

UOB's TMRW launches biometrics for accounts opening

It will be available at all 350 authentication kiosks across Greater Bangkok.

Kasikornbank introduces QR and barcode payment scheme

It will provide merchants with a one-stop app to various QR and barcode mobile payment providers.

Thai banks hit by sluggish growth

Earnings rose by a marginal 1% in Q3.

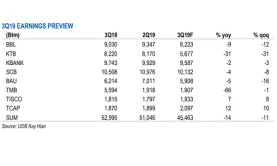

Thailand banks' Q3 profits to drop 14% as fee waiver bites

Earnings will take a hit from weak non-interest income.

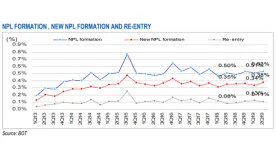

Chart of the Week: Thai banks' Q2 stressed loans hits 2.95%

NPL improvements were seen in the manufacturing and commerce sectors.

Big Thai banks keep payouts low to boost capital

Capital positions are well beyond regulatory requirements.

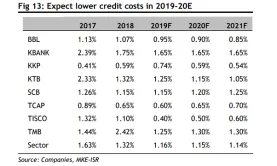

Thai banks' credit costs to fall to 1.16% by end-2019

NPL ratio has been stable at 3.9-4.0% since 2017.

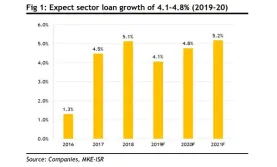

Thai banks' loan growth may slow to 4.1% by end-2019

SME loans and mortgages will grow at a slower pace.

Advertise

Advertise