Thai banks' credit costs to fall to 1.16% by end-2019

NPL ratio has been stable at 3.9-4.0% since 2017.

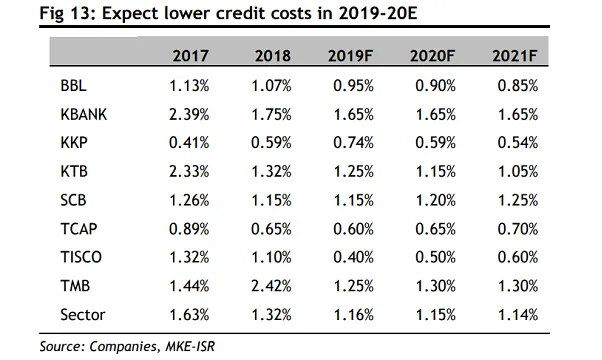

The credit costs of banks in Thailand is expected to drop to 1.16% in 2019 from 1.32% in the previous year, according to Maybank Kim Eng, as lenders actively resolve their bad debts through a mixture of loan restructuring, NPL sales and write-offs.

Although gross non-performing loans (NPLs) rose at a faster clip in 2017-18 brought about by distress in the SME and retail segments, the sector NPL ratio has remained stable at 3.9-4.0% since 2017, Jesada Techahusdin, CFA said in a report.

Also read: Falling credit costs soften earnings blow on Thai banks

NPLs may have likely already peaked in late 2018 which lends support to sector profits. Credit costs are likely to continue tapering off in the coming months after falling to 140bp in Q1 and 132bp in Q2 from 179bp in Q4 2017, a separate report from UOB Kay Hian show.

Bank earnings are likely to be insulated from credit-quality deterioration as NPL coverage averaged 152% in Q2. "[W]e prefer banks with balance-sheet buffers from high NPL coverage and limited exposure to SMEs. BBL offers the best downside protection, in our view, while SCB has the lowest exposure to SME loans amongst the big banks," Techahusdin added.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise