Singapore

Islamic banking conference to be held in Singapore

Islamic banking conference to be held in Singapore

Leading industry players to meet June 3 to 5.

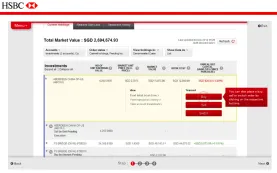

What you need to know about the new HSBC Wealth Dashboard

Cash, investment holdings displayed in real-time.

Heavy penalties for Singapore banks that facilitate tax evasion

New law takes effect in July.

2 crucial aspects of channel experiences in Asian banking

Find out how banks can shift from a multichannel to an omni-channel environment.

Philip Lee is Chief Country Officer, Singapore for Deutsche Bank

Lee is also appointed Vice Chairman, South East Asia effective from July 8.

3 areas of growth in investment banking in Singapore

Investment banking in Asia has been affected by weak earnings forecasts in the profits of targets (thus resulting in fewer large deals), increased capital adequacy regulation from regulators (so less liquidity they can put into deals which results in a reduced risk appetite for deals) and the general weak macro economy. The confluence of these factors have could be part of the reason for the reduction in general merger and acquisition activity in Asia.

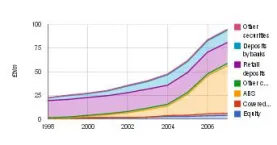

Why raising bank capital requirements will help the global economy

“Basel III” is familiar as the outcome of the financial crash of 2008. Western governments demanded almost instantaneous reaction to the bailout of some of its largest banks (no Asia-Pacific bank had to be nationalised) but it was the entire global economy that ended up with the higher capital and liquidity requirements associated worldwide with the name of a small town in Switzerland. And now the world’s banks have to gear up for these more onerous demands of the regulator.

Banks in Asia Pacific can reduce risk by embracing intra-day data

Banks in Asia Pacific have traditionally processed corporate actions on an end-of-day or even a T+1 basis but due to market and regulatory changes, are looking to move to an intra-day process.

Standard Chartered records slowest revenue growth in 10 years

Guess where the 5% drag on Group revenues came from?

Singapore banks' loan to deposit ratio boosted by robust loan growth

All three of them hit the high 80s.

Deutsche Bank named Asia's leading foreign exchange bank for 9th consecutive year

DB has 19.81% market share.

OCBC knocked off its top spot as the world's strongest bank

Guess which bank topped Bloomberg's list?

How Asian banks can revolutionise the use of social and digital media

Find out what Westpac, BPI, CIMB and Fiserv have to say.

Here's how smaller transaction banks can challenge StanChart, HSBC, Citi

Cumulative market share of the ‘Big Three’ is now down to 52.9%.

CDC and Standard Chartered sign a US$100m risk participation arrangement

Incremental trade volume in excess of US$1b is expected.

OCBC Money Insights users reach 60,000 in just two months

See what makes it a hit among customers.

UOB's Singapore loan growth at risk of slipping from 10%

To just mid-single digits.

Advertise

Advertise