Singapore

Singapore banks' 2Q13 results to be dragged by lower treasury earnings in June

Singapore banks' 2Q13 results to be dragged by lower treasury earnings in June

Trading earnings are elusive post-bond selldown.

What you must know about the new Total Debt Servicing Ratio imposed by MAS on Singapore banks

It took effect from June 29.

UBS appoints Saurabh Beniwal as SEA investment banking head

His territory excludes the Philippines, however.

HSBC makes Singapore’s first renminbi-denominated bond sale

HSBC priced USS$103m of 2-year notes.

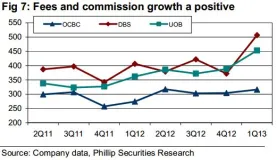

Here's why wealth management will be Singapore banks' cash cow in 2013

DBS and UOB posted record-high Fees and Commission.

Here's how OCBC lets Singapore investors buy STI stocks for as low as S$100 a month

Blue chip stocks are no longer out of reach.

2 ways to use technology against banking fraud in Asia

Bank fraud costs financial institutions in Asia a combined total of $1 billion annually – a figure that was quoted as recently as last year. But the costs of fraud go beyond just that of monetary losses. Banks have to also consider the shadow costs – such as the possible damage to their reputations, and loss or decrease of trust between them and their existing customers.

Top 10 Hong Kong banks by total assets

Guess which bank led the pack with total assets of HK$5.6t.

“Banking University” could rise in Singapore

BNP Paribas plans banking university to raise level of financial services skills.

Central banks are repeating Mr Greenspan’s mistake

Alan Greenspan, chairman of the US Federal Reserve during 1987-2006, was often heralded as the most celebrated central banker of modern times. The years after 2008 have not necessarily been kind to his professional reputation however. A number of commentators including Paul Krugman and George Cooper (the latter’s work “The origin of financial crises: Central banks, credit bubbles and the efficient market fallacy” is a very worthwhile read for all students of finance) have highlighted the long-term impact of the “Greenspan put” and how the era of cheap money during 2000-2006 was a prime causal factor of the financial crash.

JP Morgan unveils its enhanced online banking platform in Asia Pacific

ACCESS lets clients do financial transactions in a single location.

UOB and Sumitomo Mitsui launch new real estate unit trust in Singapore

The fund will offer 5% potential distribution per annum.

Only 10% of Asia's rich with median investable wealth of US$4.22m use a private bank

But 15% said they will do so in 2014.

Do you know how much Singapore banks’ CEOs are paid?

The youngest CEO is the highest paid.

Take an exclusive peek inside UOB’s new wealth banking centre in Jurong Lake District, Singapore

It has an area of 6,266 square feet.

Standard Chartered appoints Zhang Su as equity research analyst for emerging companies

Standard Chartered announced the appointment of Zhang Su as Equity Research Analyst, Emerging Companies. Su is based in Hong Kong and reports jointly to Jeremy Sutch, Head of Emerging Companies Research, and Erwin Sanft, Head of Hong Kong/China Equity Research. In this role, Su will be responsible for covering Emerging Companies in China and Hong Kong. His appointment follows that of Sumit Choudhary, Head of Emerging Companies Research in India, as the Bank rounds up our regional Emerging Companies team. Su joins Standard Chartered from Exane BNP Paribas in London, where he most recently worked as an equity strategist focusing on China. He was previously located in Shanghai, where he held roles at Standard Chartered and Pricewaterhouse Coopers. Commenting on Su’s appointment, Jeremy Sutch said, “We are very pleased to welcome Zhang Su back to the Bank, bringing with him best practices from other institutions. I look forward to his contribution as we continue to expand and deepen our equity research capability to meet increasing demands from our clients.”

Citi launches Virtual Card Accounts in 6 Asian markets

Including Singapore, Malaysia, and South Korea.

Advertise

Advertise