Chart of the Week: Mobile wallet payments pick up pace in South Korea

High smartphone and internet use drive its use.

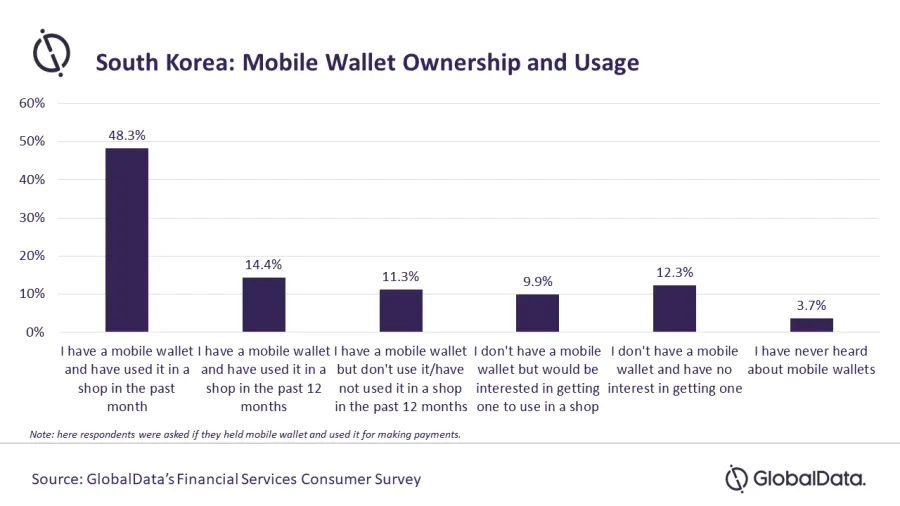

Over two in three South Koreans now use a mobile wallet, according to a financial services consumer survey conducted by GlobalData.

Less than one in 10, or 4% of respondents, said that they have never heard about mobile wallets, GlobalData’s 2021 Financial Services Consumer Survey revealed.

South Koreans are noted to be well-accustomed to mobile wallets, with the country ranking amongst the leading markets globally in terms of per capita spending using mobile wallets, said Ravi Sharma, lead banking and payments analyst, GlobalData.

High smartphone and internet penetration, coupled with the government’s push towards a cashless society, have supported the segment’s growth.

“With consumers continue to embrace cashless payments, mobile wallet payments are likely to grow further, supported by government initiatives, large tech-savvy population, growing acceptance of QR code-based payments among merchants, and increasing preference for contactless payment methods,” Sharma said.

However, whilst the mobile wallets market in South Korea is growing at a fast pace, some barriers still exist.

“Of the survey respondents who did not use a mobile wallet last year, over 30% do not perceive mobile wallets to be better than cards or cash while nearly 22% are concerned about what would happen to their payment details if their phone were lost or stolen,” Sharma said.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise