mobile wallets

India crackdown on non-bank lending to hit fintech investments

India crackdown on non-bank lending to hit fintech investments

Deal activity in Q2 was 25% lower than the previous quarter.

E-payments poised to replace credit cards in China, Indonesia: Experian

Buy now, pay later has been eagerly embraced by Indonesians.

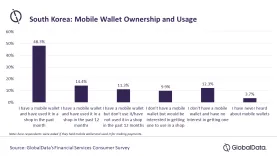

Chart of the Week: Mobile wallet payments pick up pace in South Korea

High smartphone and internet use drive its use.

The Next Pedestal of the Payments War for Banks and FIs: Buy Now Pay Later

Buy Now Pay Later (BNPL) has seen remarkable growth in recent years and is on track to achieve a global market value of US$700b by 2023. This 90% compound annual growth rate (CAGR) reflects the growing penetration of this simple transactional instrument—consumers purchasing a product now with the agreement to pay for it later.

APAC’s mobile wallet adoption chips away at traditional payments’ dominance

Mobile wallet adoption in Thailand, Vietnam far exceed those in the US, the UK.

SEA named world’s fastest-growing mobile wallet region

The number of active mobile wallets is expected to reach 439.7 million by 2025.

Advertise

Advertise