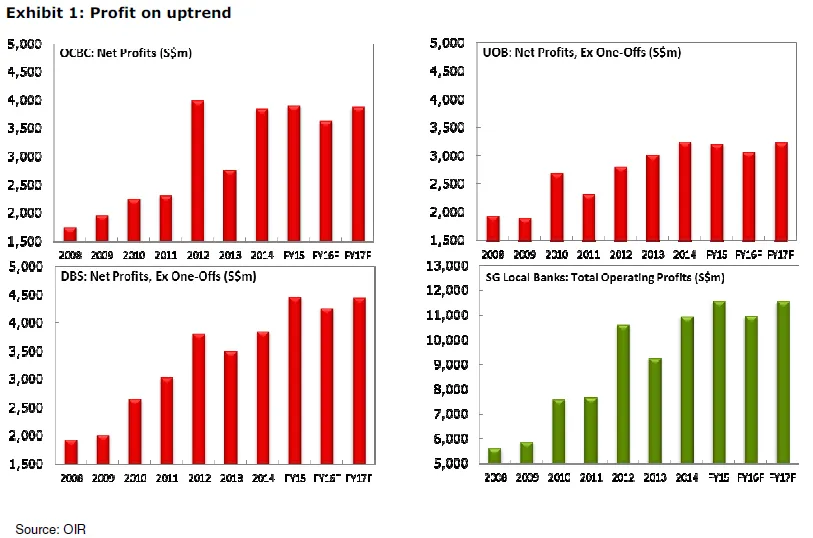

These graphs show the worst may finally be over for Singapore banks

Profits are on an uptrend.

Much has been said about the Singapore banks' exposure to the oil and gas sector and how this affects their profitability, but analysts think the worst may be over for the city state's three biggest banks.

According to OCBC Investment Research, the three local banks were the clear outperformers at the recently concluded 4Q15 earnings quarter. Earnings came in better than market expectations.

"While there were expectations of higher provisions, the amount was not excessive and non-performing loan (NPL) ratios were still within expectations. DBS reported 4Q15 net earnings of S$1002m, OCBC posted net earnings of S$960m and UOB generated net earnings of S$788m."

The analyst added that provisions rose 39% QoQ to S$247m for DBS, +29% to S$193m for OCBC and +19% S$190m for UOB. Net interest margin (NIM) improved for all three banks, from 1.78% in 3Q15 to 1.84% in 4Q15 for DBS, from 1.66% to 1.77% for OCBC and from 1.77% to 1.79% for UOB.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise