Singapore banks hit hard by higher foreign non-performing loans

DBS and OCBC are leading the increase.

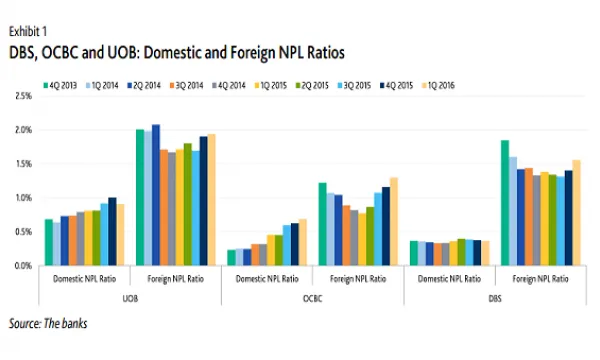

Singapore's banking sector is still fraught with challenges, as the Q1 2016 financial results of OCBC, UOB, and DBS reveal that their asset quality and profitability has further weakend compared to the results as at year-end 2015.

One of the biggest challenges the banks have to face is the alarming rise in non-performing foreign loans, with DBS and OCBC leading the increase. According to Moody's Investors Service, OCBC’s weakening in foreign loans was mostly driven by Indonesia, while DBS’ foreign non-performing loans (NPLs) increased because of its Hong Kong exposures.

"As for domestic loans, DBS and UOB posted stable or improved asset quality metrics, while OCBC reported a mild weakening. We expect that the asset quality of all three banks will continue to deteriorate because of the slowing economic and trade growth in Asia, and stress on oil and gas borrowers in Singapore."

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise