News

CIMB's capitalisation the lowest among large Malaysian banks: Moody's

CIMB's capitalisation the lowest among large Malaysian banks: Moody's

It deteriorated further in the first half of 2015.

How high can credit costs go for Singapore banks?

A 10 bps increase in credit costs lowers profit by 7%-8%.

Krungsri's non-performing loans predicted to grow 5bps to 2.6%

The annualized credit cost is likely to be reduced in Q3.

Hong Kong banks' system loans slipped 0.4% in August

Loans for use outside HK were down 2.2%.

Krung Thai Bank must brace for a tough quarter ahead: analysts

Net interest income will decline 4.5%.

Islamic banking in Indonesia to grow as demand for Sharia-compliant bonds rises

Year-to-date sales of retail sukuk have been oversubscribed.

Digital platforms to drive 20% of Indian banks' profit by 2020

Digitisation will happen sooner rather than later.

August loan growth among Singapore banks eases as consumer lending falters

Total lending grew 0.5% last month.

Singapore's tighter moneylending rules kick in starting October

To keep debts under control.

DBS's credit exposure to SMEs more than quadrupled since 2011

Analysts worry if credit selection has been bit aggressive.

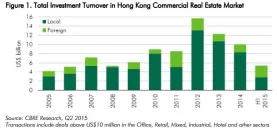

Private real estate investors target small-sized deals in Hong Kong

Two-thirds of total turnover are small deals.

Hong Kong banks' system loan dipped as trade finance nosedived

Could the recent RMB depreciation be the one to blame?

Regional online hiring activities in banking, finance sector still fluctuating

Online recruitment has been struggling.

Resilient bank stocks fraught with hidden risks, analysts warn

Bad loans and shrinking balance sheets aren't the only red flags.

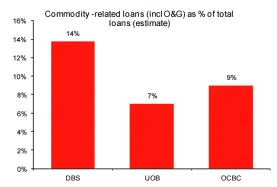

Which Singapore bank is most exposed to the struggling oil and gas sector?

Commodity-related loans could be at risk.

RBI issues 'in-principle' license to eleven entities for payments bank

Are these menaces to established banks?

HKMA's July statistics reveal mortgage loan approvals sliding down 8.8%

Blame it on sharp decline in primary market financing.

Advertise

Advertise