News

Asian central banks brace for Brexit fallout as markets wobble

Asian central banks brace for Brexit fallout as markets wobble

Regulators are prepared to inject additional liquidity.

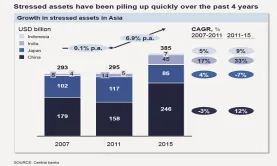

Risks mount for Chinese banks on back of rising investments in loans and receivables

Exposure to these asset classes more than quadrupled since 2012.

India's central bank governor to step down in September

Raghuram Rajan will return to the academia.

Staying profitable will be "nearly impossible" for Asian banks, says McKinsey

A trio of threats hangs over regional lenders.

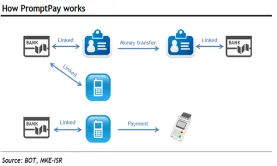

Banks’ profits to take a hit as Thailand goes cashless

Kasikorn Bank will bear the brunt of the impact.

Philippine regulator eases lending rules to spur infrastructure investment

Banks can roll out more loans for project financing.

Taiwan banks' yuan deposits fall for 4th straight month

Deposits dropped to RMB308.3 billion in April.

Thailand gears up for cashless society with launch of PromptPay

It will go live in mid-July.

Bank of Indonesia rolls out surprise rate cut as credit growth tumbles

The regulator is likely to ease further, analysts say.

Regulator backs Hang Seng Bank’s bid to launch China's first foreign-majority owned fund management firm

In collaboration with its JV partner.

StanChart mulls launching private bank in China

It would compete with Goldman and UBS.

Singapore, Australia ink deal to help fintechs go global

Licensing timelines will be streamlined.

South Korea overhauls capital control rules, tells banks to prepare for sudden outflows

Forex regulations will be eased.

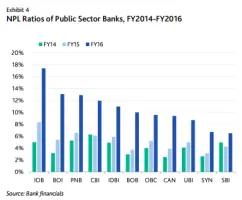

Reserve Bank of India tweaks bad loan restructuring rules for lenders

It will be used to avoid high write-downs.

HSBC clinches regulatory approval for US$5.2b sale of Brazil business to Bradesco

The transaction would generate a gain of US$600m.

Chart of the Day: Indian banks' profitability crumbles as NPL ratios jump

Loan loss provisioning expenses will rise.

Escalating oil & gas default risks won’t sink Singapore’s largest banks: Fitch

They have a combined exposure of around $49 billion.

Advertise

Advertise