News

2018 Retail Banking Forum - Kuala Lumpur a success with more than 60 attendees

2018 Retail Banking Forum - Kuala Lumpur a success with more than 60 attendees

Key executives from Malaysia's major banks graced the event.

Australian banks under tight scrutiny for a decade of corporate wrongdoing

A probe has opened a can of worms ranging from bribes to extracting fees from dead customers.

Aggregator threat closes in on open banking

Banking customers may switch now that they can compare their bank's performance with others.

Maybank expands Sunday banking services in Singapore

Maybank's Alvin Lee also shares how the bank currently innovates their branches.

Fintech patent application streamlined in Singapore

Applicants need to furnish a “Fast Track” document to be recognised as fintech.

China's shadow banking crackdown slows home market

A tightening lending environment may cause property sales to plummet.

Singapore and Vietnam tie up for fintech cooperation

Additionally, the two countries also revised a partnership on banking supervision.

Are ecosystems the key to boost bank returns?

Networks of ecosystem partners and access to more data lower costs of customer acquisition.

Nearly 2 in 5 Hong Kongers open to sharing banking data with third parties

Almost 40% believe that open banking can provide them with better customer service.

Weekly Global News Wrap Up: UBS wealth management underperforms in Q1; Embattled Wells Fargo faces shareholders and protestors

And Nigeria’s central bank has injected $210m into the interbank foreign exchange market. From Reuters: Swiss bank UBS disappointed investors on Monday with first-quarter results that revealed strong earnings at its investment bank, while its flagship wealth management business missed forecasts. UBS’s wealth business, which was merged into one global division this year, netted 19 billion francs in new money but fell short of expectations with pre-tax operating income of 1.13 billion francs. Wealth management’s disappointing performance, plus its higher costs and UBS’s cautious outlook, put pressure on the bank’s shares which fell as much as 4 percent.

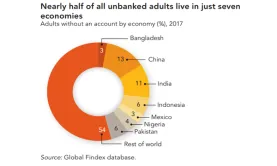

Chart of the Week: Check out which countries have the largest unbanked populations

Two Asian countries snagged the top two spots.

Bank account ownership in India surges to 80%

The Jan Dhan Scheme has brought an additional 310 million people into the banking system.

Philippine banks go digital with launch of electronic fund transfer service

InstaPay enables transactions of up to PHP50,000 per day.

China's RRR cut cushions lenders against impact of shadow banking crackdown

The cut aims to encourage banks to move from WMPs to deposit funding.

India's banking woes dampen economic outlook

The banking sector is saddled with $210b in problem loans. Bloomberg reports that India’s chronic bad debt problem has spiraled beyond the control of the formal banking sector to the extent that it has dampened economic forecasts for the country. "The problems in India’s banking system are self-inflicted mostly because of lack of due diligence," said N.R. Bhanumurthy, a Delhi-based economist at the National Institute of Public Finance & Policy. "Of course this will affect growth."

Hong Kong banks scrap fixed-rate mortgages as interbank lending rates surge

HSBC and BOC have stopped offering the popular loans whilst ICBC will stop on May 1.

Indonesia makes headway in curbing its unbanked population

Almost half of adults now have a bank account, up from a fifth in 2011.

Advertise

Advertise