News

India's bad debt burden is the second worst globally

India's bad debt burden is the second worst globally

Trailing only behind Italy, the country has a bad loan ratio of 11.6%.

Myanmar steps up oversight over share acquisitions by foreign banks

Foreign investors are allowed to acquire up to 35% stake in local firms.

China greenlights establishment of overseas banks

Arab Bank has received the green light to set up a Shanghai unit.

Australian customers embrace smaller banks as top four bear brunt of scandal

Customer satisfaction was high for mid-sized lenders like Bendigo and ING.

Philippine banks explore blockchain for payment and remittance services

The central bank approved a pilot project creating a real-time remittance corridor.

Over three fourths of the Philippine population is unbanked

This translates to only 15.8 million Filipinos out of 103.3 million.

How will looser mortgage rules weigh down on Indonesian banks?

The central bank earlier scrapped the 15% required downpayment for first-time home buyers.

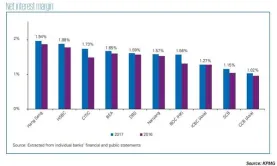

Chart of the Week: Check out how profitable Hong Kong banks were in 2017

Average NIMs of the largest lenders from 1.43% in 2016 to 1.54% last year.

Weekly Global News Wrap Up: Mastercard in talks to launch biometric payment cards; Uzbekistan opens door to Kazakh lenders

And here's how Citi's hoping to lure deposits without opening branches.

Higher mortgages loom as Singapore banks move to offset dismal lending

Some banks have been reportedly scrapping fixed deposit linked packages in favor of Sibor pegged packages.

Vietnamese banks' strong lending dampens capital raising activities

Loan growth of about 20% is outpacing internal capital generation.

Lending crunch fails to cripple Japan's mega banks as they join world's largest 20 lenders

MUFG is the ninth largest bank globally with a tier 1 capital of $153.04b.

Cooling measures to improve Singapore banks asset quality

This comes as a welcome development amidst slower loan growth.

7-Eleven stores in Thailand to start offering banking services

The convenience store operator is aiming to be a commercial bank agent.

Korean banks secure clearance to expand foothold in India

KEB Hana Bank and KB Kookmin Bank are looking to tap into India's growing wealth.

Cash is still king in Hong Kong as only a fifth embrace e-payments

Nearly 70% cite that they remain unfamiliar with the tech required to go cashless.

Indonesia's loan growth will receive little boost from lower LTV regulation

Analysts believe banks should be willing to extend loan terms to support this development.

Advertise

Advertise