News

Chart of the Week: Australia and Hong Kong banks hit by negative property sentiment

Chart of the Week: Australia and Hong Kong banks hit by negative property sentiment

The decline in property prices may drive loan impairments up.

Weekly Global News Wrap Up: US banks brace for deal frenzy as 2017 M&As doubled to $196.5b; JP Morgan targets mid-sized firms in European pivot

And UAE and Saudi Arabia have deployed digitla currency for settlements.

Thailand mulls harsher stance against cash transactions

Banks are considering additional fees as it aims to speed up e-payment adoption.

India's ATM industry struggles with steep compliance costs

Half of the infrastructure may close down by March 2019.

Chinese regulator refuses to let up on banking crackdown with $22m fine

This represents one of the largest penalties in 2018.

Singapore banks embark on hiring spree in fight against dirty money

As a result, IT security professionals can command up to 30% in pay hikes.

Hong Kong cuts down a third of virtual banking applicants

They failed to submit sufficient information on authorisation criteria.

Hong Kong's open banking movement lures interest beyond retail

SMEs and corporates also acknowledge the merits of the pivot.

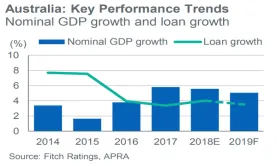

APAC banks brace for slowdown as GDP growth peaks

Loan growth will slide across the region.

Emerging Asian banks may outpace developed peers in credit gains

The Philippine and Thai infrastructure campaigns will fuel borrowing.

Weekly Global News Wrap Up: Brexit may slash London bank assets by $909b; Swedish banks mull Stibor alternative

And EU is moving to enhance its money laundering defense.

Chart of the Week: Mortgage slowdown to hit Australian bank loans in 2019

Housing loans constitute over 60% of their overall banking credit.

Hong Kong banks make do with falling loan growth as earnings lifeline

Gains from Chinese business will remain limited.

Indonesian banks refuse to pass rate hike burden to consumers

Borrowing costs remain low as lenders hope to stoke consumption.

Korean banks' bad loan ratio falls below 1% in Q3 for first time in a decade

Shipping corporates are making good headway in the crackdown.

Chinese banks' wealth management units greenlit to buy shares

It aims to boost market confidence amidst a cooling economy.

Hong Kong banks' loan growth eases to 2% in October

This represents the fourth straight month of decline.

Advertise

Advertise