News

Japan banks bid goodbye to centuries-old tech in paperless shift

Japan banks bid goodbye to centuries-old tech in paperless shift

Hanko or personal stamps are being phased out.

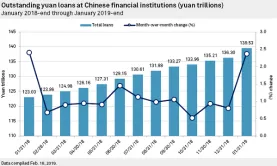

Chinese banks' new loans falls sharply to $131.8b in February

This is only a third of the $480.75b in loans issued in January.

E-money transactions in Indonesia hit $3.3b in 2018

Users turned to digital money for e-commerce, mobile SIM top-ups, and public transport.

Trade tensions fail to rattle Chinese banking outlook: survey

Two in 5 bankers believe China’s economy will grow by around 6.5-7%.

Malaysian banks' earnings rose 7% in Q4

Lumpy recoveries of Maybank, AmBank, and Hong Leong Bank boosted the sector’s earnings.

Chinese banks' record-high lending boost only short-term gains

Short-term loans surged 57.8% in January whilst mid- and long-term loans only rose 5.3%.

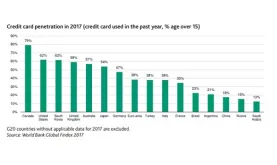

Korea's open banking system threatens dominance of credit card issuers

Credit card issuers may lose their tax incentive to fintechs.

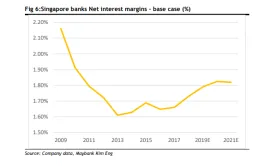

Singapore bank NIMs to widen despite rising costs

SIBOR has risen 6bps YTD and is expected to rise further.

Regulatory scrutiny weighs on Australian banks earnings

Lenders already struggle with weak loan growth amidst the housing downturn.

Weekly Global News Wrap Up: Russian money laundering scandal sweeps European banks; Wells Fargo shells out record $240m settlement over bogus accounts

And JPMorgan Chase is moving away from prison finance.

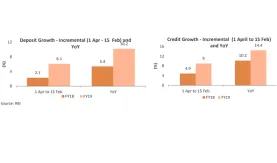

Chart of the Week: Indian banks hit by liquidity crunch

The growth in bank credit has eclipsed that of deposits which aggravated liquidity shortage.

Japanese players cash in on China's financial opening as US banks flounder

JPMorgan Chase is still stuck in application stage despite passing an application in May 2018.

Earnings gap between Indonesian banks widen as small players struggle

The 2018 profits of Book II banks dropped to $648.66m from $726.38m in 2017.

Philippine banks' loan growth cools down to 15.7% in January

Household loan growth slowed to 12.7% in January from 13.6% the previous month.

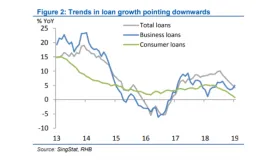

Singapore bank loan growth down to 4.2% in January

Consumer loan growth fell to 0.7% whilst business loans increased 5%.

Bank-backed online loan approval platform in India plugs SME funding gap

Since its launch in November 2018, the platform approved loans worth $4.23b.

Thai government to buy $318m of shares in TMB-Thanachart merger

It chose to invest because it believed that the merger would yield a more efficient bank.

Advertise

Advertise