News

Chinese banks still see long-term stability ahead

Chinese banks still see long-term stability ahead

The sector is cushioned enough to absorb eroding asset quality.

UOB's net profit down 19% to $855m in Q1

Total impairment charges skyrocketed 96% to $286m.

2020 tipped to be the worst year for China's retail savings and investments

Losses will affect China’s high net worth segment significantly.

Weekly Global News Wrap: JPMorgan cleared to make $15b in new loans to small firms; BNP Paribas posts 33% crash in net income

And Norwegian wealth fund backs Barclays’ climate talks.

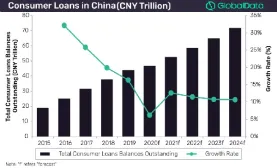

Chart of the Week: China's consumer lending market growth to stall at 6.2% in 2020

This is ten percentage points lower than the 16.3% growth recorded last year.

Major Australian banks may take long to recover from headwinds

Hefty loan impairment charges may remain elevated.

UOB extends $2.83b in loans to mid-sized enterprises

The bank also tapped MAS SGD Facility to help clients access funds at lower interest rates.

Singapore's MAS extends scope of loan deferments

Starting 6 May, individuals with specific loans may apply to defer repayments until 31 December.

Coronavirus triggers switch to contactless payments in APAC

Health concerns made contactless payments more favourable to consumers.

Major Australian banks to absorb higher credit losses: report

Credit losses are likely to rise six times from historic lows in 2019.

COVID disruptions intensify risks for Chinese banks

Regional banks are more vulnerable due to weak capitalisation.

Thai banks' Q1 earnings down 8% YoY to $1.12b

The sector saw a 20-25bps growth in loan yield.

Pandemic's impact on APAC banks to stay ‘longer than expected': Fitch

Downturns will be steeper than a normal cyclical downturn and stay until 2021.

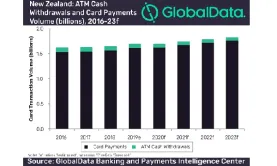

Chart of the Week: New Zealand card payments to grow 2.2% annually through 2023

The pandemic will slow card payments adoption as consumers switch to online payments.

Coronavirus drags on Chinese leasing firms' profits

Those with no parent banks to bail them out will be the most severely impacted.

Singapore lenders to report healthy Q1 loan growth as firms amp liquidity

But credit charges are expected to rise further.

Weekly Global News Wrap: Tech issues hamper US banks' bid for $310m small firms aid; EU floats relief to support extra lending

And Allianz inks bancassurance deal with BBVA.

Advertise

Advertise