News

Sustainable fund inflows reach record high, but Asian firms register slowdown

Sustainable fund inflows reach record high, but Asian firms register slowdown

Asia ex-Japan and China lost $22m of funding in Q4.

Bank of the Philippine Islands' issues $373m fixed-rate bonds due 2024

BPI Rise Bonds have an interest rate of 5.75% per annum.

UnionBank net income up 12% to $233.59m in 2022

Revenue hit a record high, whilst consumer loans rose after acquiring Citi’s assets.

Thailand's KBank targets 5-7% loan growth in 2023

Thailand's economy will recover unevenly, varying across different businesses, KBank's CEO noted.

High inflation, interest rates may increase Southeast Asian banks’ loan problems

Both asset quality and profits will weaken but should be manageable, says Moody’s.

RHB Singapore offers 4.28% interest for its 12-month fixed deposit

The promotional rate is available only at RHB’s refreshed Cecil Branch and Premier Centre.

Hong Kong’s card payments market to hit $106.7b in value by 2026

But rising interest rates and ongoing geopolitical tensions threaten growth.

Singapore banks to report flattish Q4 22 earnings amidst slow global growth

NIMs will rise but the expansion could decelerate due to higher funding costs.

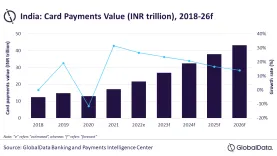

Chart of the Week: India’s card payments market to reach $581.2b by 2026

The card payments market value grew 26.7% in 2022, according to estimates.

Weekly Global News Wrap: BNP Paribas vows to slash oil lending; Bank of America employees awarded restricted stock

And Barclays names ex-Credit Suisse dealmaker as head of investment banking.

China overseas loan commitments dwindle as firms adapt “small is beautiful” approach

Only 28 new loan commitments were recorded in 2020 and 2021.

Korean banks’ bad loans ratio up 0.02ppt in November

Ratio reflects loans overdue by at least one month.

India’s Yes Bank saw profit drop 80% in Q4 2022: report

The bank aims to recover INR10b in the current quarter, its chief executive said.

Australian structured finance issuance slowdown imminent in 2023: S&P

The multiple interest rate raises will begin to bite on issuers.

Filipinos spent 9 years in total using digital lending apps in 2022

Over 2.3 million users actively used a digital lending platform at least once a month.

DBS Hong Kong offers two-in-one instant loan and credit card combo

Users just need to scan their HKID to get both cash and a digital card in a single application.

Dah Sing Bank, Sun Life enter bancassurance partnership in HK$1.5b deal

Beginning July, Sun Life will be the exclusive provider of life insurance solutions to Dah Sing’s customers.

Advertise

Advertise