Singapore’s investment banking fees rise 3.3% in first half of 2022

However, DCM underwriting fees were slightly lower than in 2021.

Singapore investment banking activities generated US$451.3 million in fees so far this year, a 3.3% increase compared to the first half of 2021.

Investment banking activities in Singapore continue to tick up in 2022, generating US$451.3m in the first half of the year, according to data from Refinitiv. This is 3.3% higher compared to the first six months of 2021.

Both advisory fees for completed mergers & acquisitions (M&A), as well as underwriting fees from equity capital markets (ECM), drove the gains. M&A advisory fees totalled US$171.7m in the first six months of 2022, a 10.9% increase from the same period last year.

READ MORE: Singapore’s $35b green bond sale lifts sustainable financing capabilities

ECM underwriting fees reached US$77.8m, up 9.7% compared over the same period of comparison. These were slightly offset by a 1.7% decrease in debt capital markets (DCM) underwriting fees. Underwriting fees amounted to US$85m so far in 2022.

Syndicated lending fees also fell 6.3% in the first half of 2022 to US$116.9m.

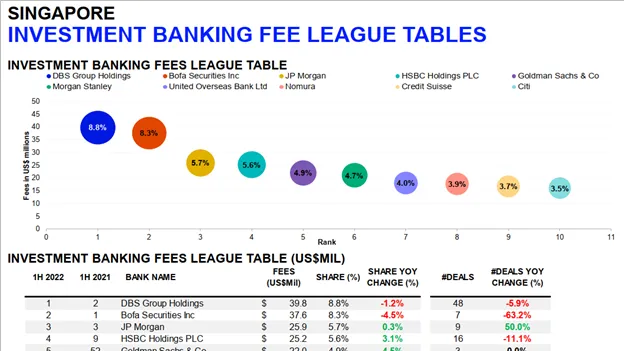

Amongst banks, DBS currently takes the lead in Singapore’s investment banking fee rankings so far this year with a total of US$39.8m or an 8.8% wallet share of the total fee pool. DBS has 48 related deals so far.

READ MORE: DBS grants A$295m green loan to GIC

The 10 banks with the highest investment banking fees logged a total of 149 investment banking deals in the first half of 2022, or 23.2% lower than the same period in 2021.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise