Singapore’s fintech funding hit three-year high for an H1 period, but fizzles from H2 2021

The funding was the highest for a first-half period since 2019, but 15% lower than in H2 2021

Singapore’s fintech funding hit a three-year-high for a first half period in H1 2022, with firms securing US$2.14b across venture capital (VC), private equity, and mergers & acquisitions (M&A), according to data released by KPMG. This is a 64% jump than last year’s US$1.31b.

However, the number is 15% lower than in the last six months of 2021, when funding totalled US$2.51b. This reflects greater caution from investors in reaction to “market developments,” according to KPMG.

Venture capital (VC) funding towards the Lion City also dropped 30% in H1 2022 compared to H2 2021. Companies in Singapore received US$1.38m in funding across 107 transactions in the first half of 2022. In comparison, although H2 2021 recorded fewer deals at 103 transactions, it garnered US$1.97m in VC funding.

“Whilst the VC market experienced headwinds this year with investors pulling back in anticipation of interest rate hikes and geopolitical tensions, the VC fintech funding still remains resilient especially with robust seed funding,” KPMG reported, citing thatthe first half of 2022 performed better than the first six months of 2021, which logged US$1.02m worth of VC investments.

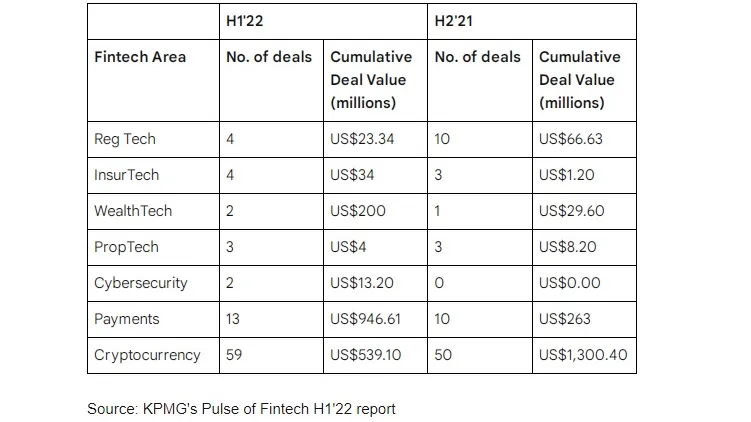

Investors notedly chose to channel funds into payments – an area that has been demonstrating stable growth and developments, alongside more cross-border initiatives being forged, according to KPMG. Deal value for payments in Singapore nearly tripled from US$263m in H2 2021 to US$946.61m in H1 2022.

In contrast, funding towards cryptocurrency fizzled, dropping to only US$539.1m in H1 2022. This is less than half the US$1.3b the sub-sector received just six months prior. This comes after Singapore began tightening cryptocurrency rules. Notably, the Lion City barred crypto service providers from publicly promoting their digital payment token (DPT) services to the general public.

Although crypto fintechs attracted smaller deal sizes, the sub-sector recorded a larger number of deals with a significant amount of startup funding–two thirds from seed and early-stage VC funding, KPMG noted.

The crypto space also reportedly saw a small amount of consolidation with seven exit or merger deals, it added.

Regtech also saw investments plunge to US$23.34m in H1 from US$66.63m in H2 2021.

Looking ahead, the fintech market should expect challenges to continue in H2, said Anton Ruddenklau, global head of financial services innovation and fintech, KPMG International.

"2021 was a banner year for the fintech market globally, which makes the first half of 2022 seem slow by comparison. "But in reality, many sectors within the fintech market have shown strength and resilience. Whilst the fintech market will likely be quite challenged in H2 2022 due to global uncertainty and broader economic concerns, fintechs will likely continue to attract significant attention and investment - if at lower levels than last year,” Ruddenklau said.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise