Singapore

Singapore regulator slams IBM; orders DBS to choose another vendor

Singapore regulator slams IBM; orders DBS to choose another vendor

In a stingingly critical assessment of the failure of IBM systems at DBS, the Monetary Authority of Singapore has ordered DBS to "reduce its material outsourcing risks so that it does not overly rely on a single service provider," which effectively means it is ordering DBS to find another vendor.

OCBC sees greener pastures as Asian economy improves

But misses second quarter forecast behind 24% surge in operating expenses and 40% in staff costs.

DBS' net interest margins fall to 1.84% in the second quarter

The bank said more than half of the margin decline was due to a shift in the securities portfolio towards higher-quality issues with lower yields.

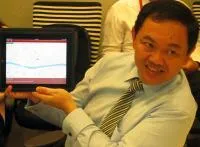

OCBC offers iPad banking and trading applications

OCBC becoming the first financial institution to launch applications for one of Apple’s latest gadget, continues to pull on technological innovation for its clients and investors.

Investors as company stewards – the future?

At the beginning of July, the world saw its first Stewardship Code being launched – in the UK. It will require institutional investors to commit to shareholder engagement or explain why they cannot. Although it will only apply to UK-based investors in UK-listed companies it is likely to attract attention globally, given the international nature of today’s companies. Some even believe that it is reasonable to assume that responsible ownership and investment will become the norm for major significant investors worldwide by 2020. So what is stewardship? According to a study by Tomorrow’s Company in 2008, it is one of four areas of shareholders’ responsibilities, alongside the provision of finance, the election of directors and holding them accountable, and the trading of shares to set the market price. A key responsibility under the stewardship umbrella is to keep companies’ management to account, ensuring they perform, are aware of risks as well as opportunities, and plan for the future. The Code builds on reviews of the governance of banks and other financial institutions, carried out in the UK last year, and comes as a response to concerns raised about the quantity and effectiveness of engagement between institutional investors and boards of listed companies, with questions being asked about whether they challenged company managers enough. It also builds on the Code on the Responsibilities of Institutional Investors, prepared by the Institutional Shareholders’ Committee. This has been adopted on a voluntary basis in the UK for some years already, What does the code entail and why is it relevant to other markets? In the UK, the concept of active share ownership is key to the governance of listed companies. The thinking behind the Code is that it will contribute to improving the stewardship, and thus the governance, of listed companies. That, in turn, should assist the efficient operation of markets and increase confidence in business and trust in the financial system. It should increase transparency and benefit the ultimate owners of a company, who are typically quite detached. We also believe that it will further encourage dialogue between investors across country borders. Stakeholders that fed back on the consultation by the UK Financial Reporting Council, which oversees the Code, were broadly supportive of the idea of shareholders to disclose whether, how or when they will engage actively with the management of a company in which the invest. However, they raised some concerns over it becoming too onerous or prescriptive. While the Code to a great extent only formalises what is already quite widely adopted as best practice it marks an important shift in how the running and responsibilities of companies are weighted. Many investors, both in the UK and elsewhere, already follow the majority of the rules spelled out in the Code, however, for it to become truly effective, it needs to be given time to become truly ingrained and mature. While disclosure on implementation is important, the critical part is how the policies have been implemented. If it only turns into a box-ticking exercise, not much will be achieved by it. The success of it also depends on how it might be replicated in other markets, as broader adoption is required if market behaviours are going to see a real change. To exemplify; in the 1990s the percentage of shares held by foreign investors in UK companies stood at just over 10%, in 2008 this level had climbed above 40%. In other words, real change is only likely to be seen if the Code is adopted more widely across the world. As with all new rules, there will be cost implications. However, we believe that the benefits will outweigh these costs and should not discourage adoption of the Code. Any expense should be recouped through increased trust and confidence. We look forward to following and participating in debates about the Code here in South East Asia.

Phased reduction in interest withholding tax to boost bank access to offshore funding in longer term

A phased reduction in interest withholding tax for Australian banks and foreign banks operating in Australia seeking to access funding from offshore markets was announced in May 2010 as part of the Australian Federal Budget 2010-11.

Why changing customer demands will reshape banking in Asia-Pacific

A lot is written about the pressures on banks created by regulators, financial markets, and the overall health of the economies in which they operate. However the change that is most likely to redefine banking as we know it comes from customers.

Restoring business trust and confidence in the financial institutions

The recent global financial crisis hammered home a painful but clear reminder that risk is pervasive, and can have far-reaching consequences.

Employment trends in banking - Singapore market

The financial services industry has seen a resurgence in hiring activity as the Asian economic outlook has shown signs of improvement since September 2009. While this trend relates to all areas of financial services, there has been particularly strong jobs growth across the following business functions: Risk management remains crucial Post the global credit crunch, risk management has clearly become a critical function in the industry. This has driven banks to start thinking more about risk: whether it is market risk, credit risk or operational risk. Consequently, we have seen a surge in demand for people with expertise in these specific areas. Singapore emerges as an operations hub Singapore is fast emerging as an operations hub for the region with a number of international banks moving their operations and technology teams to the region over the last year. This has created to a strong demand for experienced staff within operations, especially those who have control or project management exposure. Compliance and control remains important While banking industry starts to grow again, there continues to be a strong emphasis on compliance, internal audit and control related functions. These positions are needed to help organisations stand up to closer scrutiny, as the industry looks to new performance indicators to assess an institution’s success. There is stronger M&A activity in the region With the increasing attractiveness of Asia as an investment destination, we have seen an increase in the hiring of corporate finance profiles as banks revalue their investment opportunities and actively look at potential investments in the region. A boom in Product control There are strong opportunities for qualified accountants within the product control function as banks are paying a lot more attention to the control mechanisms underpinning their activities. Private banking is coming to the forefront Already the world's second largest private-banking center, private banking in Singapore continues to grow, as tough secrecy laws and favorable taxes attract big accounts throughout Asia, hence creating opportunities across a number of areas in private banking.

Payments ecosystem – are financial services really seeing the changes occurring?

Financial Institutions should take note of the changing environment in payments. The payments ecosystem is transforming itself into something many have not yet fully grasped. It is the industry that many have yet to look at within their strategic radar.

DBS introduces new card design

The bank releases a new card design featuring Singapore’s skyline.

DBS forges new saving scheme for parents

DBS launches EduSmart to address concerns and uncertainties that parents face today on deciding how much they need to provide for their children’s future.

Fitch says DBS and OCBC are stable

Fitch's affirmation of DBS and OCBC's stability status reflects the banks' strong credit profiles.

44% of Asian insurers still optimistic

Some parts of the world may have experienced a global downturn but Asia's insurance business remains largely unaffected by the economic crisis.

Rabobank appoints Philip Lau Southeast Asia M&A Head

Appointee seen to strengthen lender's corporate finance with his 15-year experience.

Maybank Singapore gives away $5mln cash rewards

Pocket Me GIRO intends rewarding customers when they GIRO with the lender.

HSBC appoints Mark Troutman as Head of Sales, Southern Asia, Global Payments and Cash Management

Appointee leads regional team reinforcing commitment to expand Global Payments and Cash Management in South Asia.

Advertise

Advertise