Singapore

3 things Lim Kiat Seng will prioritize in his new role at JP Morgan

3 things Lim Kiat Seng will prioritize in his new role at JP Morgan

As the new head of financial institutions - sales, treasury services, Lim is planning for a back-to-basics approach.

Here's how banks can select the right systems integrator in Asia

Implementing a core banking system leads to a large and complex project, which involve high risk and multiple stakeholders - a classic case for hiring a Systems Integrator to handle the complexity. (Flyvberg and Al, 2003; Altshuler and Luberoff, 2003; Miller and Lessard, 2000; Morris and Hough, 1987).

What you need to know about Maybank's 2 new retirement plans

Maybank aims to get RM250 million in premiums in the first year.

3 ways to avoid unplanned outages in Asian banks

High Availability is a Business Decision Before automated teller machines, customers looking to access banking services had no choice but to wait in line at a bank, during its opening hours. Today, online and mobile banking platforms have provided customers with instant access to the majority of banking services, creating a new reality for banks.

Threats and challenges for online banking security

Online Banking offers users the convenience of managing one's finances anytime, anywhere. However, any online transaction can be vulnerable to security threats.

Rising leverage poses rating risks for Asia-Pacific banks

High or rapidly increasing leverage, together with mounting exposure to China, will constrain upward rating momentum for banks in Asia-Pacific (APAC). It could even lead to downgrades should China's economy slow more sharply than expected and weaknesses in its banking system become more widespread.

What Asian banks can learn from Metro Bank's Chairman

The New Bank on the Block: Lafferty spoke with Anthony Thomson, Metro Bank

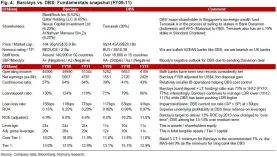

Here's why DBS is more profitable than Barclays

Find out how emerging Asia-centric DBS beats developed market-centric Barclays despite having only half of its equity leverage.

Kris Hendrieckx talks with Asian Banking & Finance on next two Sibos events in Asia

Sibos will be back in Singapore in 2015 and Asian Banking & Finance interviewed Sibos Head Kris Hendrieckx to talk about what Asian bankers can expect from the next two Sibos events in Asia.

Hong Kong and Singapore retain their talent as financial services struggles

The employment markets in Hong Kong and Singapore financial services are less buoyant than they were 18 months ago; banks have been making redundancies, and recruitment remains comparatively low. Despite this, financial professionals show few signs of wanting to leave these cities. But while they still like living there, they are now considering local opportunities in other industries.

Real-time analytics unleashed

In its 2012 Predictions: Competing for 2020 report, IDC states that 40 percent of banks will ramp up to launch big data and analytics. This is expected as the financial services industry has always been ahead of the technology curve; and nothing defines the landscape more than big data and analytics today.

Asian Banking & Finance Awards 2012 winners revealed

Find out who the winning banks are in this year’s Retail Banking Awards and the inaugural Wholesale Banking Awards.

Singapore's banks on the look-out vs European tax evaders

Banks in Singapore have been warned since last year against funds being transferred to evade taxation elsewhere.

Maybank Singapore unveils mBanking app

It is the industry's first that allows transaction from Singapore to Malaysia.

The end of outsourcing as we know it?

The recent allegations1 and eventual settlement2 against Standard Chartered regarding lapses in their anti-money laundering (AML) controls has made headlines in recent days, with significant impact on their share price and damage to their reputation, apart from the fine of US$340M. What is interesting to note is the finger pointing that is arising out of this incident.

Continued churn makes it a low-hire job market, not a no-hire one

The last 12 months have taught us that Asia Pacific is not immune to the redundancies that have swept through global financial services. There are also fewer roles available than a year ago: comparing Q2 2012 with Q2 2011, APAC opportunities on my company’s website have fallen 14%.

Singapore banks brace for weaker non-interest income

Trading-related income fell 39% qoq to S$764m in 2QFY12, says CIMB.

Advertise

Advertise