China

China Construction Bank posts 25% net profit growth

China Construction Bank posts 25% net profit growth

China Construction Bank registered a 25.48% growth in its $26.89 billion net profit in 2011.

Top Chinese banks post embarrassingly high profits

Seven of China’s leading banks lean on interest income to book record profits.

Minsheng Bank to raise US$1.4 billion

China Minsheng Banking Corporation, Ltd needs some US$1.4 billion to meet tougher government regulations.

Gulf States a gold mine for China’s top bank

The Industrial and Commercial Bank of China's assets and lending double, thanks to the booming demand for trade financing.

GRGBanking signs contract with Philippines' ECTK Solution

ECTK will buy ATMs H22N/L and E300L from GRGBanking to provide service to local banks and financial institutions.

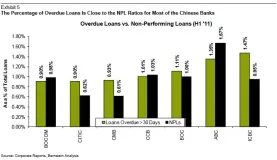

Chinese banks' overdue loan portfolio

Research shows the banks' overdue loan ratios have a close correlation with their NPL ratios.

BoCom to replenish depleted funds

Shanghai-based Bank of Communications intends to offer the world’s largest share sale since May 2011.

Chinese senior bankers subjected to stricter standards

Senior management of China's financial enterprises under the central government will have less discretion in running their firms.

SPD Bank ups profits by 42%

Rising net interest incomes, commissions and lower operation costs pushed the earnings of Shanghai Pudong Development Bank up 42.28% year-on-year.

GRGBanking's total profit up 13% to US$94m in 2011

Its revenue also rose 21% to US$331.59m.

Chinese bank lending lower than expected in February

Chinese banks extended 710.7 billion yuan or $112.5 billion in new loans in February, well below market expectations of 750 billion yuan.

Loans gush from top Chinese banks

The Big Four Chinese banks ramp up lending in an effort to stave off a further weakening of the Chinese economy.

GRGBanking to launch Cash-4-All suite in Miami, USA

The official launch will be on March 11-14.

Chinese banks loosens stranglehold on struggling property market

China begins to relent after two years of resorting to almost Draconian measures to cool down an overheated property market.

ICBC now allows cash advances through mobile phones

ICBC rolled out its "cardless cash advance" service that could be availed through mobile phones.

Bank of China, Huaxia Bank offer lowest rates for first-home buyers in China

Chinese banks have begun offering preferential loan rates for first-home buyers.

Why are Chinese enterprises net withdrawing money?

Could it be that they are keeping their money elsewhere - perhaps in CNY accounts in Hong Kong?.

Advertise

Advertise