What you must know about Islamic banking in Bangladesh

By Md. Touhidul Alam KhanIslamic banking operates with the same purpose as conventional banking except that it operates in accordance with the rules of Shari’ah, known as Fiqh al-Muamalat (Islamic rules on transactions).

Islamic banking activities must be practiced consistent with the Shari’ah, which also contributes in Islamic economy. Many of these principles upon which Islamic banking is based are commonly accepted all over the world, for centuries rather than decades.

The principle source of the Shari’ah is The Qur’an followed by the recorded sayings and actions of Prophet Muhammad (pbuh) i.e. the Hadith. Where solutions to problems cannot be found in these two sources, rulings are made based on the consensus of a community leaned scholars, independent reasoning of an Islamic scholar and custom, so long as such rulings to not deviate from the fundamental teachings in The Qur’an.

Islamic Banking in Bangladesh

ISLAMIC banking in Bangladesh will celebrate Golden Jubilee in the year 2033 on the eve of its accomplishment of 50 year of banking. And the present shape of the Islamic Banking is being modernized in terms of this changing scenario forecasting on world economy in the year 2033.

Understanding realizing this importance, the central bank (Bangladesh Bank) of the country introduced the 'Guidelines for Islamic Banking'. The central bank stated that as Islamic banking has become a part of mainstream banking in Bangladesh, it has become necessary to introduce the guidelines to bring greater transparency and accountability to the Islamic Banking.

In fact, by this circular Islamic banks have got legal framework recognition by Bangladesh Bank as well as Government of Bangladesh. Islamic Bank Bangladesh Limited, first Islamic Bank in Bangladesh has gained first position in the all-private banks in term of deposits, investment, export and import and remittance collection in the country.

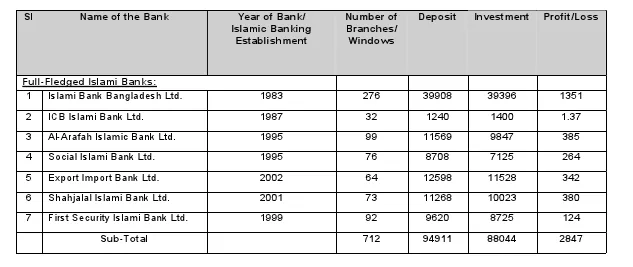

Islamic financial institutions in Bangladesh and their status

In 1983, the Islamic Bank Bangladesh Ltd., first of its kind in the country started Islamic banking operation. Now 22 (twenty two) Islamic banks are operating shariah based banking.

The banking sector of the country consists of the different categories, which are governed and regulated by Bangladesh Bank- the central bank of the country.

Out of 47 banks in the system, 22 (7+15) nos. of banks are having Islamic banking operations. In addition to these 47 banking institutions there are 29 non-bank financial institutions (NFBIs) in the country who are also regulated by the central bank as per relevant laws of the country.

Two of these; Islamic Finance and Investment Ltd., and Hajj Finance Company Ltd., operate on Islamic principles.

The Investment, Deposit, Number of Branches/Windows and Profit/Loss position of different categories banks are in Table 1A and 1B (as on 30.09.2012)

(Amount in crore taka)

Investment-Deposit position under shariah: compared with conventional banking

It has been shown that Islamic Banking constituted more than 20% of deposits and advances of the total banking system of Bangladesh.

Refer to Figure 1 and 2.

Why Islamic Banking is getting momentum in Bangladesh

There has an explanation for Bangladesh’s Islamic finance boom. Bangladesh is the world’s third largest Muslim majority country, with Muslims making up more than 80 percent of the nation’s 148 million population.

And due to majority of Muslim population and religion prohibits earning or paying interests, Islamic banking makes it possible to operate interest-free business and gaining its momentum in Bangladesh.

Islamic banks and finance institutions cannot receive or provide funds for anything involving alcohol, gambling, pornography, tobacco, weapons or pork. The growth rate of Islamic banking in the country is 15 to 20 percent while that of conventional banks is 10 to 15 percent. Islamic finance is one of the fastest growing sectors in the financial industry in Bangladesh.

Islamic banks can provide efficient banking services to the nation. This helps them introducing PLS (Profit Loss Sharing) modes of better in terms of good opportunity to work as a sole system in an economy. That would provide Islamic banking system to fully utilize its potentials.

Evidences from Bangladesh indicate that Islamic banks can survive even within a conventional banking framework by which over from PLS to trade related modes of financing. Even under the conventional banking framework Islamic banks can operate with certain level of efficiency by applying in a reasonable percentage the PLS modes.

Having been considered the pro-efficiency character of Islamic banking and its beneficial impacts on the economy, government policy in Bangladesh is in favour of transforming conventional banking system into Islamic banking.

The strengths of Islamic banking that served well to protect Islamic banking during the global financial crisis while many conventional banks and financial institutions collapsed, including some with global stature and renown.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise