DBS clinches most investment banking fees in Singapore

Deutsche Bank is the top bank for M&As, whilst Citi took the largest share for ECM underwriting.

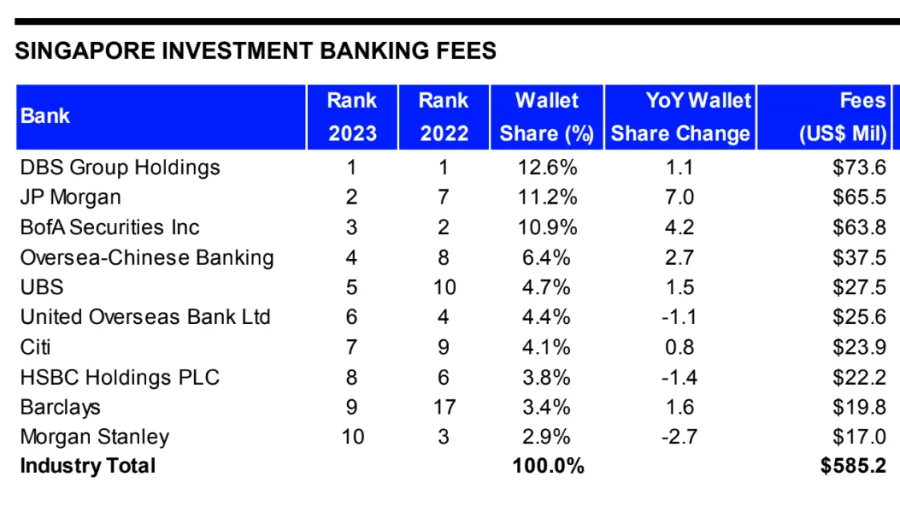

DBS Group Holdings has captured the biggest share of investment banking fees in Singapore across the first nine months of 2023, according to data from Refinitiv.

DBS has amassed US$73.6m in fees in total. Whilst 13% lower compared to the same period in 2022, it was still a 12.6% portion of the whole fee market, and enough to buoy the bank to the top of Refinitiv’s rankings.

Notably, DBS has captured the most proceeds in Singapore’s debt capital markets underwriting, with US$2.1b of related proceeds or a 12.5% market share.

ALSO READ:DBS's Sanjoy Sen explores digital currency, future M&A opportunities

JP Morgan clinched 11.2% of all fees, equal to US$65.5m. This is over double the fees it amassed during the same period a year ago.

BofA Securities rounded out the top three with US$63.8m in fees, a 29% increase from a year ago.

Overall, Singapore’s investment banking activities generated 20% lower fees in the first nine months of 2023.

Per activity, Deutsche Bank takes the top spot in the any Singapore involvement M&A financial advisor league table so far during the first nine months of 2023 with a 17% market share.

Citi took the largest share of fees related to Singapore’s equity capital markets underwriting, with a 24% market share.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise