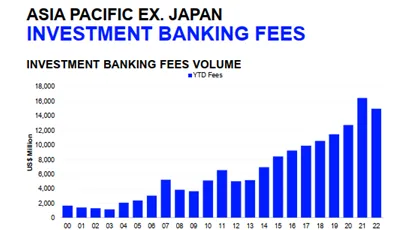

Chart of the Week: APAC investment bank fees down 9% in H1

ECM fees fell 42% after a record-setting 2021.

Investment banking fees in Asia Pacific, excluding Japan, reached an estimated $15b in the first half of 2022, down 9% compared to the first six months of 2021, according to data compiled by Refinitiv.

Refinitiv attributed this to the region “witnessing the strongest period [in investment banking activities] last year.”

Equity capital markets (ECM) fees fell 42.9% after last year’s best-ever first-half period, for a total of $3.2b.

In contrast, debt capital markets (DCM) underwriting fees rose 13% to $7.9b, surpassing the record set during the first half of 2020. DCM fees accounted for 53% of the APAC investment banking fee pool, whilst ECM underwriting fees accounted for 21.3%.

READ MORE: APAC investment banking fees drops 8.5% in Q1 2022

Fees generated from completed mergers and acquisitions (M&A) hit a four-year high and totalled $1.8b, 10.5% higher than the same period in 2021.

However, by the number of announced deals, Asia M&A fell 22.2% compared to 2021.

Syndicated loan fees dropped 7.6% and reached $2b.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise