Chart of the Week: Find out how big Thai banks' bancassurance partnerships boost fee income

It's a win for overall profitability that has been under high credit costs.

The bancassurance partnerships of big Thai banks such as Siam Commercial Bank, TMB Bank, and Bangkok Bank will boost fee income and diversify its income stream, particularly at a time when overall profitability has come under pressure from high credit costs, Moody's Credit Outlook reports. The banks partnering up with insurance companies in 2017 and early 2018 aims to distribute unit-linked products to the banks' customers.

Here's more from Moody's:

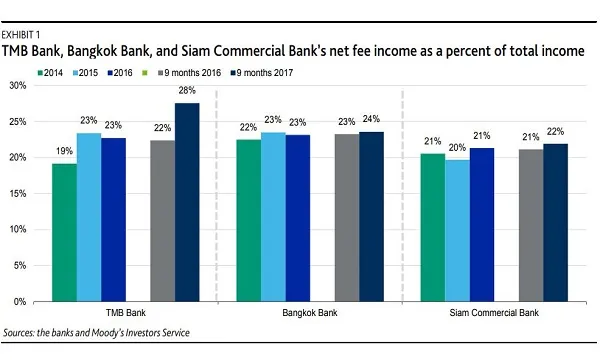

These partnerships are credit positive because they allow the banks to grow fee income and diversify their income streams. For example, for TMB, the partnership with FWD led to a 32% year-on-year increase in net fee income for the bank in the first nine months of 2017. As a result, as seen in Exhibit 1, TMB’s net fee income to total income in the first nine months of 2017 increased to 28% from 22% the year before. Since the partnerships for BBL and SCB were only announced after September 2017, we expect the positive effect on profitability to accrue over the next few quarters.

The bancassurance partnerships are also credit positive given the backdrop of declining profitability as Thai banks grapple with high credit costs from continued asset quality weakness, and low overall loan growth. Net income as a percentage of tangible assets for our rated Thai banks has declined meaningfully over the past few years as a result of rising credit costs. In addition, the low overall system loan growth limits the contribution of net interest income to overall profitability.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise