Chart of the Week: Check out how China's shadow banking lending is rising rapidly

Overall stock of total social financing grew 13.3% in November.

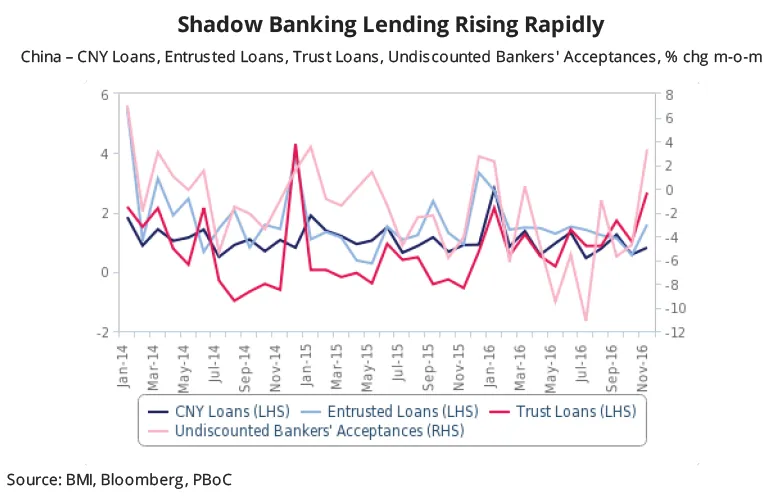

According to BMI Research, China's shadow banking system appears to be propping up overall credit creation in the mainland economy, suggesting that efforts by policymakers to slow growth in the opaque sector have not been effective.

Here's more from BMI Research:

According to data from the People's Bank of China (PBoC), the overall stock of total social financing (TSF) expanded by 13.3% y-o-y in November 2016, trending higher from the low of 12.2% y-o-y recorded in July.

In November, on a m-o-m basis, the stock of entrusted loans, trust loans, and undiscounted bankers' acceptances grew by 1.6%, 2.7%, and 3.3%, respectively, which were much faster than CNY loan growth of 0.8% in November.

With the Chinese government keen on ensuring stability in the financial system, we believe that it is likely that the PBoC and the China Banking Regulatory Commission (CBRC) will curb shadow lending activities.

We therefore expect shadow lending (which are often recorded off-balance sheet) growth, particularly those included in the TSF data, to moderate over the coming months as there is increased oversight by the regulators.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise