Chart of the Week: Consumer debt financed by Chinese banks amount to USD2.6t at end-2015

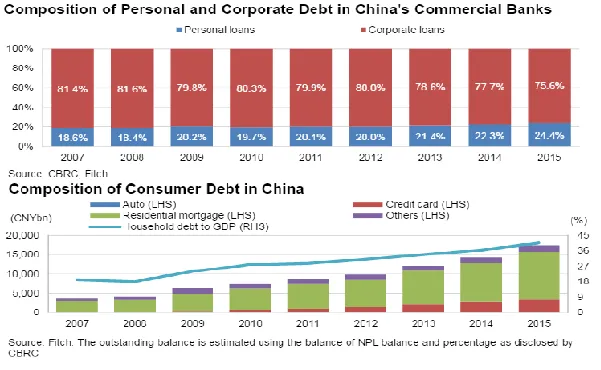

Consumer debts comprise 24.4% of Chinese banks' loans.

According to Fitch Ratings, debt to individual consumers in China has risen quickly in the last few years. It believes the situation should be monitored closely but believes the risks are manageable at present.

Here's more from Fitch Ratings:

Consumer debt in China has been on the rise as a portion of total assets in the banking sector and in absolute terms. The portion of loans to consumers has increased modestly from 18.6% of bank lending in 2007 to 24.4% in 2015.

In absolute terms, the consumer debt financed by Chinese banks grew from CNY3.8t (USD584b) at end-2007 to CNY 17.4t (USD2.6t) at end-2015, representing a CAGR of 21%. Household debt to GDP has risen continuousely since 2008 (earliest available data), when it was 18.2% compared with 40.5% as of end-2015.

A large portion of consumer debt is residential mortgage lending, which made up approximately 71% of total consumer-related debts in the commercial banking sector in 2015, and grew at a compound annual growth rate (CAGR) of 20.6% between 2007 and 2015.

The portion of credit card lending grew at a CAGR of 56.7%, and stood at CNY3.2t. 'Other' consumer loans may include all other types of consumer debt, eg personal durable goods loans, student loans, personal unsecured loans.

This segment of consumer debt grew at a CAGR of 9.3%, and was CNY1.7t at end-2015. The auto-loan balance represented here does not include that for auto-finance companies (AFC) in China.

Based on information disclosed by China Banking Regulatory Commission, total auto loans (including auto leases) outstanding at AFCs stood at CNY320.4b at end-2014. The credit-card balance also includes credit card instalment loans taken out for the purchase of vehicles.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise