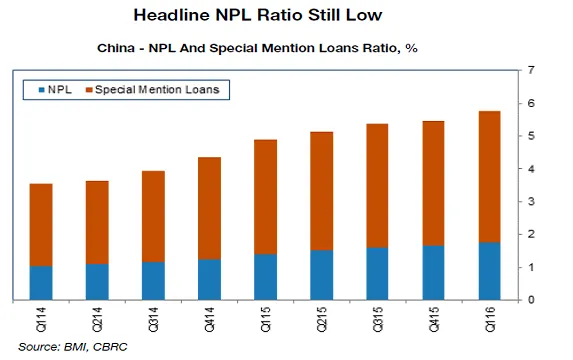

Chart of the Week: China's NPL ratio still highly understated at 1.8%

True NPL ratio could be as high as 30%.

The China Banking Regulatory Commission reported that headline non-performing loan (NPL) ratio rose to a multi-year high of 1.8% in Q216 (from a low of 0.9% in Q309). Analysts at BMI Research asserts this figure is highly understated as Chinese banks manage their reported NPL ratios closely and have extended the amount of time that a loan can be overdue before they classify it as bad, particularly for state-owned enterprises (SOEs).

Here's more from BMI Research:

We estimate China's at-risk credit ratio at approximately 20% (as of end-2015), and acknowledge that it is difficult to accurately pinpoint the exact NPL ratio in the mainland economy due to the opacity of Chinese banks and a lack of data for unlisted non-financial sector companies.

In order to get a better understanding of the NPL situation in China, we adopted the IMF's methodology from its April 2016 Global Financial Stability Report (GFSR) by looking at a sample of approximately 2,800 non-financial corporates listed on the Shanghai and Shenzhen stock exchanges.

We quantified bad debt for all interest-bearing borrowings for companies that fail to meet the IMF's EBITDA/interest criteria of less than 1.0x and also using a typical financial stress metric of EBIT/interest of less than 1.0x, and lastly, we took an average of the two. We highlight that our base-line estimate is not particularly strenuous, suggesting that the situation could be much worse.

For instance, if we were to tighten the IMF's EBITDA/interest criteria to its April 2014 GFSR level of 2.0x and EBIT/interest to 1.5x, the NPL ratio would hit around 30%.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise