Staying profitable will be "nearly impossible" for Asian banks, says McKinsey

A trio of threats hangs over regional lenders.

What goes up must come down, and Asia's banks might be in for a painful landing after a long decade of unmatchable growth.

A report by global consultancy McKinsey revealed that the Asian banking industry is "already weaker than many suspect", and warned that generating profit will only grow tougher and tougher in coming years.

"As banks in Asia-Pacific settle into the new reality, three formidable challenges are forming that will make it nearly impossible for banks to sustain the status quo profitably. These developments— slowing macroeconomic growth, new attackers that are taking away customers and reducing margins, and balance sheets weakened by a rise in non-performing loans—will test traditional business models and growth strategies," the report said.

McKinsey's analysis of 328 banks in the region showed that while 39 percent posted an economic profit in the period from 2003 to 2006, only 28 percent did so from 2011 to 2014.

In China, for instance, McKinsey expects the growth of banking profits to drop from 10% annually from 2011-2014 to just 3% from 2016-2021.

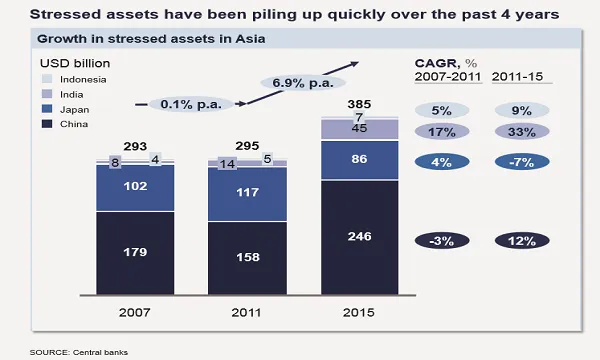

Apart from slowing growth, the rise of disruptive tech players and the continued increase in non-performing assets will also cripple banks' ability to stay profitable.

"These three threats may come together in a powerful storm that could cripple ROEs by 2018. Indeed, banks already see the impact of the changing environment," said the report.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise