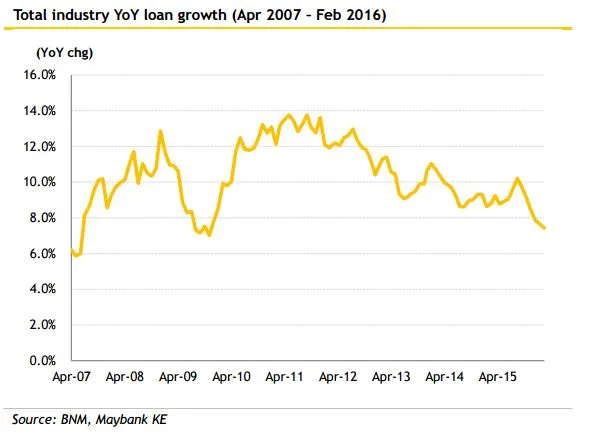

Malaysia's industry loan growth disappoints as household loans slip to just 7%

A mere 6.5% loan growth is forecast for 2016. According to Maybank Kim Eng, industry loan growth continues to slow, with the moderation in HH loan growth notably more significant in Feb 2016.

While still early days, our 2016 industry loan growth forecast of 6.5% (7.9% in 2015) is still within reach and this is premised on HH loan growth of just 6.1% and non-HH loan growth of 7.0%.

Here's more from Maybak Kim Eng:

Annualized industry loan growth in Feb 2016 was just 2.0% and was just 7.4% YoY (7.7% YoY end-Jan 2016). HH loan growth slipped notably to just 7.0% YoY end-Feb 2016 from 7.6% YoY end-Jan 2016 but positively, non- HH loan growth held firm at 8.0% YoY vs 7.8% YoY end-Jan 2016.

Loan applications rose 5.5% YoY on a 3M MA basis but loan approvals contracted for the sixth consecutive month i.e. by 10% YoY in Feb 2016. Overall approval rates were broadly stable but a surprise was that the mortgage approval rate dropped to just 43% in Feb 2016 from 46% in Jan.

Industry deposits growth was hardly changed at just 1.2% YoY in Feb 2016 versus 0.9% YoY in Jan 2016. CASA growth was just a tad faster at 2.5% YoY in Feb 2016 versus 2.1% YoY in Jan 2016.

The industry’s loan/deposit ratio (LDR) dipped to 88.0% end-Feb 2016 from 89.0% end-Jan 2016 while the loan/fund ratio slipped to 82.3% from 83.3% end-Jan 2016. Absolute NPLs crept up marginally MoM by 0.8% and rose at a moderate pace of 3.2% YoY.

The MoM increase was across almost all major HH segments, balanced off by a decline in working capital NPLs. The industry’s gross NPL ratio was stable at 1.61% but loan loss coverage slipped further to 92.8% end-Feb 2016 from 95.6% end-Jan 2016.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise