Here's proof that RMB customer payments in Europe rocketed 163%

Will Europe overtake Asia in RMB trade settlement?

According to a release, when RMB trade settlement was opened up in June 2012 for any corporate in the world, adoption was to start regionally in Asia and then expand to Europe, the Americas, Middle East and Africa. That may have been so.

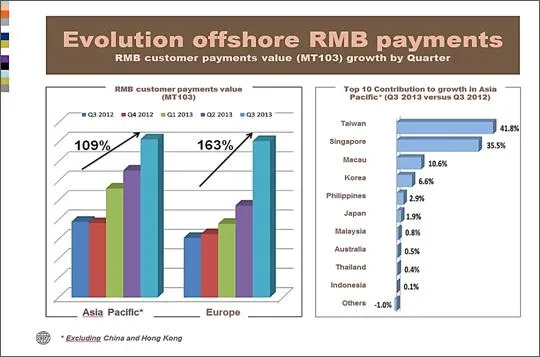

Recent SWIFT data however shows that RMB customer payments – a good proxy for trade settlement - in Europe grew by 163% over the last year, much higher than the 109% observed in Asia (excluding China and Hong Kong) in the same period. Growth in Europe was particularly strong in Q3 of this year, bringing Europe in absolute value almost at par with Asia.

Growth in the value of RMB customer payments in Asia was mainly driven by Taiwan and Singapore, with adoption remaining relatively low in Australia and Japan.

Patrick de Courcy, Deputy Chief Executive and Head of Markets & Initiatives, Asia Pacific at SWIFT says: “Our business intelligence indicates that China's major trade partners in Europe are now embracing the RMB for trade settlement.

It is “game-one” for those banks, as not all are capturing this emerging RMB business to the same extent. Back in Asia, recent initiatives by e.g. the Monetary Authority of Singapore to strengthen China-Singapore financial cooperation may help to increase adoption of offshore RMB by financial institutions in this region.”

In September 2013, the RMB remained stable in its position as the #12 payments currency of the world, with an increased market share of 0.86% compared to 0.84% in August 2013.

Overall, RMB payments increased in value by 4.6% in September 2013, whilst the growth for all payments currencies was at 1.2%.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise