Here is the flip side to Hong Kong's impressive loan growth

Total system LDR jumped 60bp.

According to CCB International, it continues to be resilient (+1.3% MoM, +16.9% YoY) while system deposits continue to lag behind (+0.5% MoM, +10.3% YoY). Total system loan-to-deposit ratio increased 60bp to 72.4% while HKD LDR inched up 10bp to 83.7%.

They also said that RMB deposits continue to record strong growth (+2.1% MoM). “The mortgage market remains tepid as mortgage loans approved fell 8.5% MoM to HK$11.5b though loans for primary market transactions rebounded 44.5% MoM from a low base to HK$1.6b. Share of HIBOR- based mortgages declined from 40% to 28% and total outstanding system mortgages remained flat (+0.1% MoM) at HK$899.6b,” CCB International said.

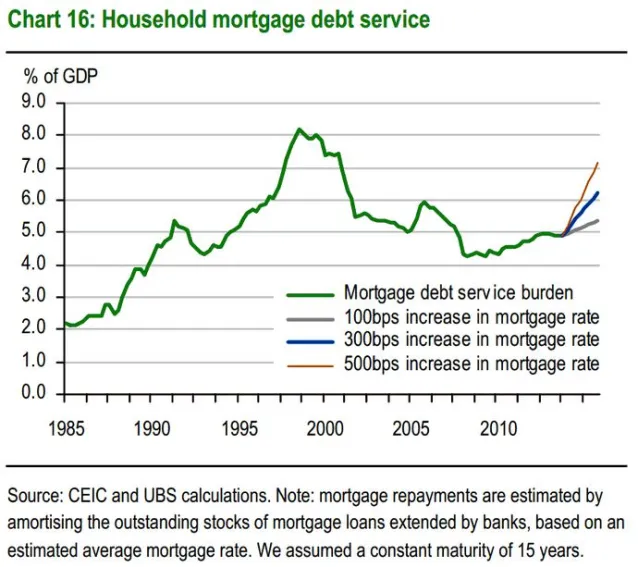

But here is the scary catch. According to UBS Investment Research, the government has repeatedly warned about the risks of higher interest rates. “With the Fed looking set to be holding rates unchanged for quite some time, how is that possible? Well, we have seen banks re-price mortgage rates before. That happened during 2H11-1H12 when HKD liquidity tightened on the back of the European debt crisis,” UBS Investment Research said.

Mortgage rates rose by a full 100bps to 2.8% in mid-2012 from a record low of 1.8% in 1H11. But inflows resumed in late 2012, driven in part by US QE3, pushing rates lower again. So the bottom line is, in the case of outflows, HKD deposits could stagnate or even decline, pushing up the loan-to-deposit ratio. Banks would likely then have to hike mortgage rates, independent of US rates movements, for commercial reasons.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise