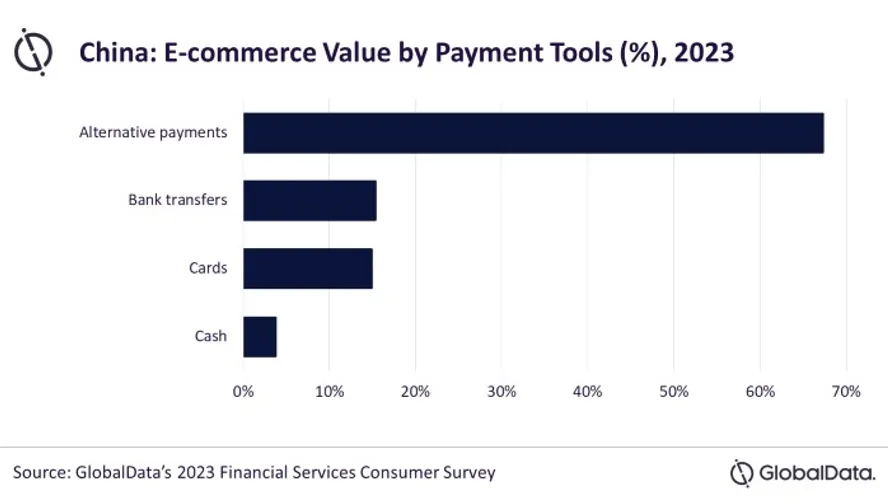

Chart of the Week: 2 in 3 e-commerce transactions in China use alternative payments

Alternative payments make up 67% of the market share.

Alternative payment methods now account for 2 in 3 payment transactions in China’s ecommerce market, reports data and analytics company GlobalData.

In 2023, alternative payments accounted for 67.3% of the market share, according to the GlobalData’s 2023 Financial Services Consumer Survey.

Alipay and WeChat Pay, with more than one billion users each, are the most popular alternative payment methods in China.

ALSO READ: Loan rate cut weighs on Chinese banks’ interest margins, profits

Alternative payments are followed by bank transfers and payment cards. Cards account for a 14.9% share of e-commerce transaction value in 2023.

Credit cards are more preferred than debit cards due to the value-added benefits they offer including interest free installment payment options, reward programs, cashback, and discounts, according to GlobalData.

Overall, the Chinese e-commerce market is expected to grow by 11.9% in 2024 and reach $2.45t, and grow to $3.6t by 2028. Alternative payments are expected to continue their dominance, driven by a growing user base and increased online merchant acceptance.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise