Number of fintechs in SEA to double by 2027

Singapore will have 867 fintechs for every 1 million people, UnaFinancial said.

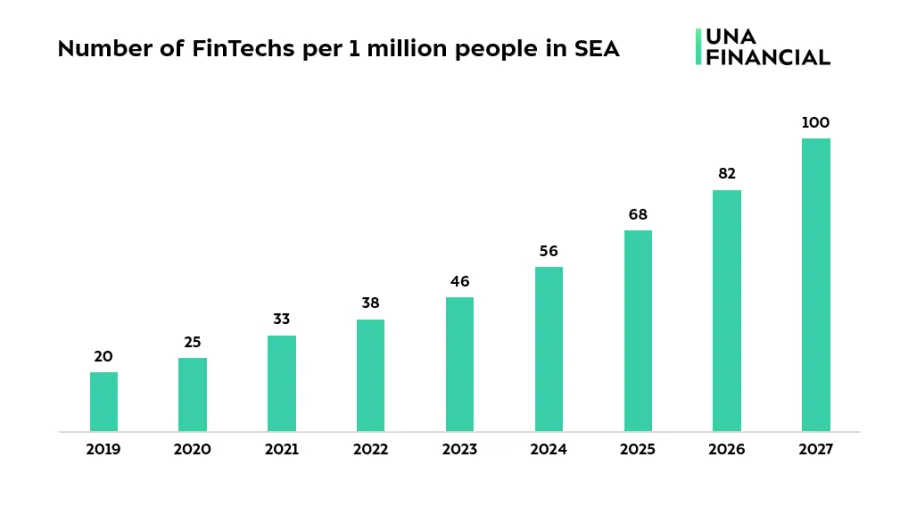

The proportion of fintech companies in Southeast Asia is expected to double in three years’ time, according to a study by UnaFinancial.

A study by UnaFinancial posits that there will be 100 fintech companies per 1 million people in SEA by 2027. This is double the average fintech penetration in 2023, which is 46 fintechs per 1 million people.

Singapore and Malaysia are expected to continue leading in terms of absolute penetration of fintech per capita in the region with 867 and 60 companies per 1 million people, respectively.

Brunei (21), Vietnam (16), and Cambodia (13) will follow suit.

In 2023, Singapore has 400 fintechs per 1 million people; and Malaysia has 22 companies per 1 million people.

ALSO READ: How HomePay is combating renovation scams in Singapore

The burgeoning middle class will drive up fintech growth in these markets, UnaFinancial analysts said.

“Another reason is the growth of the super-platform economy driving eCommerce, ride-hailing, food delivery and other popular services that employ digital payments and fintech,” UnaFinancial wrote in a report.

Regulatory frameworks across SEA are also highly accommodative, particularly for new digital innovations related to fintech, it added.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise