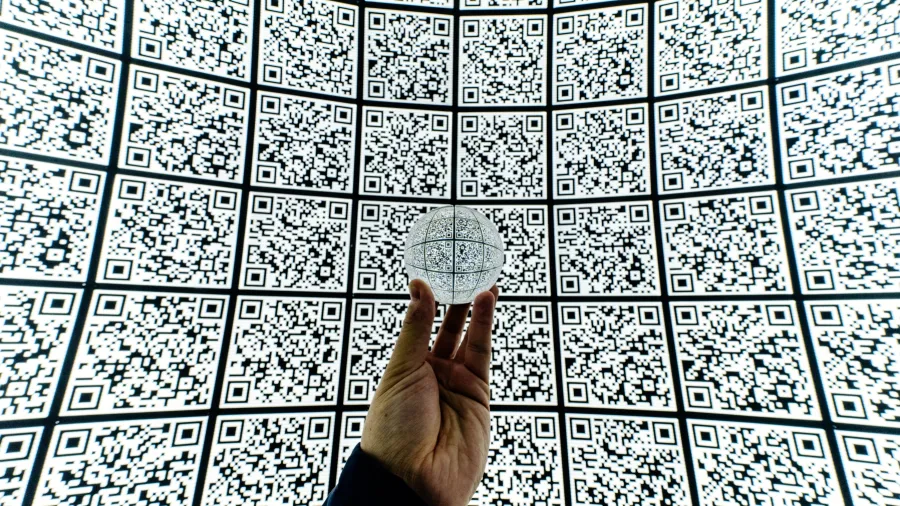

QR payments seen to skyrocket by 2028 – Study

Its transaction volume is expected to reach 90 billion by 2028.

The volume of Quick Response (QR) code transactions in the Southeast Asia (SEA) region is forecasted to jump more than 590% to 90 billion in 2028, according to Juniper Research.

For the year, the research said it expects QR code payments to accumulate about 13 billion.

This growth in SEA, mainly in developing areas, is due to the financial inclusivity of QR payments, aiding unbanked users.

In contrast, Western regions show limited adoption, highlighting a global QR payment divide.

National QR payment schemes like India's UPI and Brazil's Pix drive adoption, with Kenya and Bangladesh implementing similar schemes in 2023.

Market growth will come from cross-border interoperability within SEA.

ALSO READ: UnionPay inks deal with Cambodia to promote QR cross-border payments

While international interoperability exists, national QR payment standards are now unifying across borders.

Indonesia, Malaysia, and Thailand have done so, letting businesses accept international payments via domestic digital wallets. Singapore and the Philippines aim to collaborate by 2023's end.

To bolster QR payment use, payment providers should work with legislative bodies for interoperability.

In the West, QR payment adoption is low, but QR peer-to-peer bank transfers gained traction since 2022 with services like Belgium's Payconiq and Spain's Bizum. Revolut and Vipps MobilePay promote QR solutions in Europe with reduced fees.

“To maximise adoption, payment providers should focus on offering competitive pricing versus established local payment methods.” Juniper Research said.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise