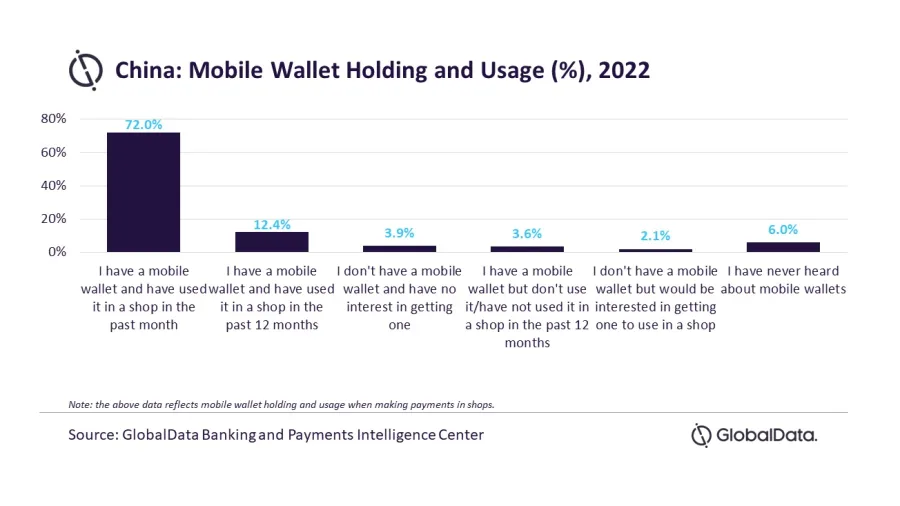

Chart of the Week: 8 in 10 Chinese consumers use mobile wallets

High cost of POS terminals and insufficient payment infrastructure push e-wallet use.

Over 8 in 10 people in China use mobile wallets, according to a survey by data and analytics company GlobalData.

High cost of point-of-sales (POS) terminals, and generally insufficient payment infrastructure have pushed both merchants and consumers to leapfrog from cash to mobile-based payments, skipping payment cards.

China is amongst one of the top countries globally in terms of mobile wallet adoption and usage, which has surpassed traditional forms of payment like cash and cards.

“China is home to one of the most mature mobile wallet markets in the world. Mobile wallets are a mainstream payment instrument in China and widely used for day-to-day transactions at supermarkets, grocery stores, street vendors, and public transport, as well as for online transactions,” said Shivani Gupta, senior analyst banking and payments, GlobalData.

ALSO READ: How Mocasa is using BNPL to supercharge the Philippines' credit payment market

In fact, the adoption level is much higher compared to developed markets like the US and the UK, where consumers still predominantly use cards, GlobalData said.

“Chinese consumers are far ahead of their Western counterparts in terms of mobile wallet usage. The availability of high-speed internet facilities, coupled with a rise in smartphone penetration provided the foundation for mobile payments to thrive,” said Gupta.

“This was also supported by its widespread QR code infrastructure, and rising consumer and merchant preference for electronic payments in the country,” he added.

![Lorem Ipsum [ABF 1]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-03/a_hand_pointing_to_a_futuristic_technology_5b87c9d0e3_1.png.webp?itok=2w0y1WhS)

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

Advertise

Advertise